Baseball & Bonds: Playing the Field

By Michael McKeown, CFA, CPA - Chief Investment Officer

The ideal pitch is a fastball down the middle. It’s obvious. It’s the pitch hitters can drive with a high probability of success.

But it is not always so easy.

Pitchers throw off speed pitches too. Curveballs move. They are slower. Hitters have to be patient, waiting for the pitch to get there in order time the swing just right.

Hitters can only take what the pitcher is giving them and try to put it in the field of play. Investors can only take what the market is giving them as well.

What does the pitch and field of play look like for investors today?

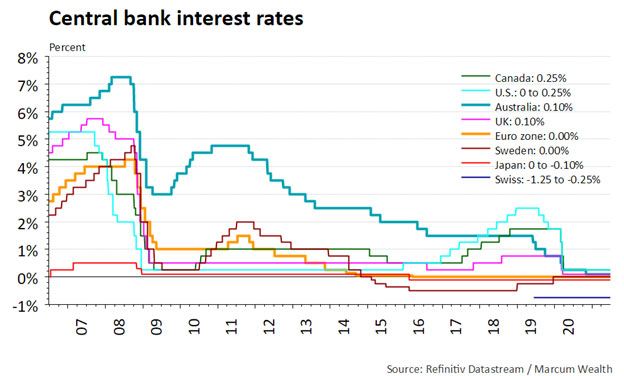

In developed markets, short-term interest rates are at the zero lower boundary. But yields globally do not behave in a vacuum. Investors around the world from pension plans to sovereign wealth funds are looking for opportunities to earn any return on capital.

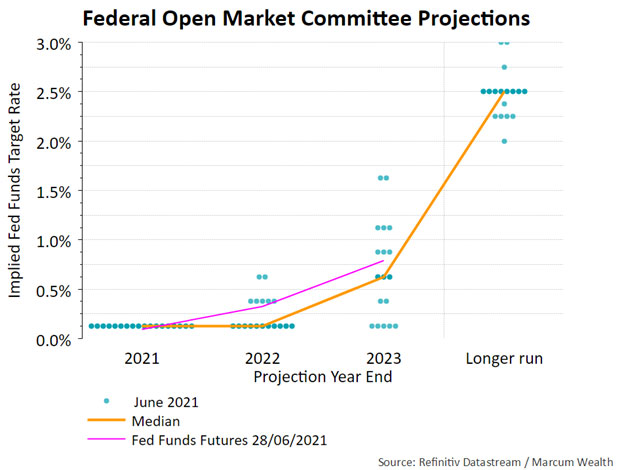

Markets are beginning to price the end of zero percent interest rates in the U.S. The potential for three interest rate hikes is now on the table by the end of 2023. This would follow the theme of this economic recovery being on fast forward, compared to the post-2008 economy. Still, many strategists think we will be waiting longer for hikes to happen.

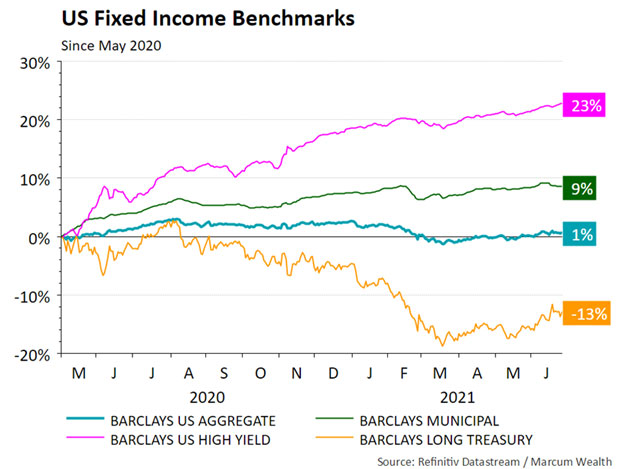

It has paid to take on credit risk over the last year. High yield and lower-rated debt performed well following a rapid decline in March 2020. Quality bonds such as Treasuries and the Aggregate Bond Index have lagged, but historically this presented an opportunity.

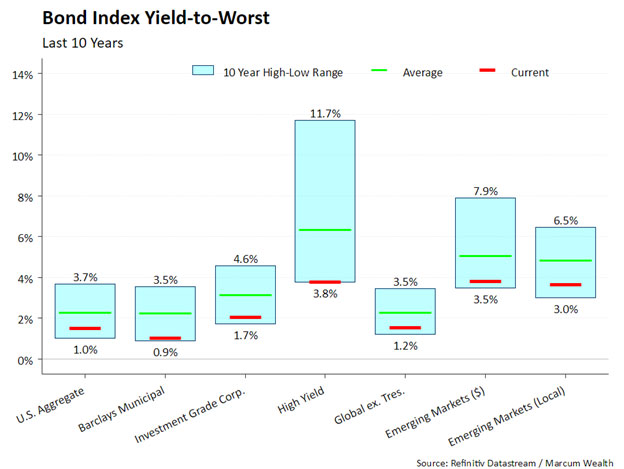

With the economy and companies outperforming expectations, it is no surprise to see yields at the low end of the last decade. Yields across the board are below 4%.

Investors may be better served with patience like a batter at the plate, looking for the right pitch.

Still, some investors are pressing. Many are pushing further out into riskier options, such as private credit. These also price off the low yields that are available in public markets. Often these go to fund middle market companies or buyouts, which will correlate to the equity side of portfolios.

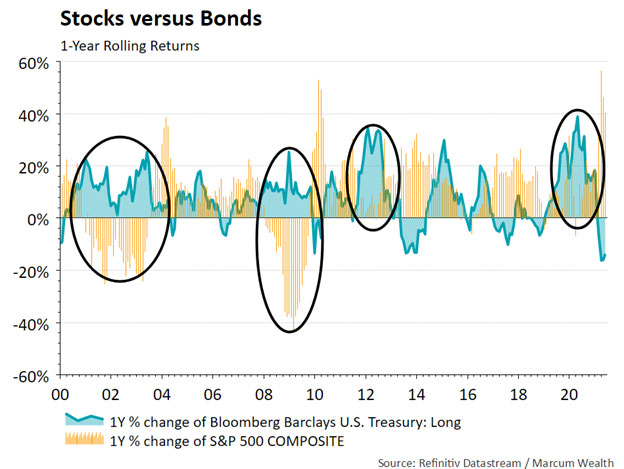

An area that many have given up on is high quality bonds, such as Treasuries. While the yields are not high, Treasuries have historically acted as a diversifier for portfolios, especially with equities.

Investors need to be on the look-out for curveballs that may not be apparent. The economy remains robust, so it is a positive environment for credit. Still, it seems this is a time for patience at the plate when looking to deploy cash. The area looking the most valuable for portfolios as a whole points to quality.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.