CARES Act – What You Need to Know

By Alynne Zielinksi, MBA, CFP®, CDFA - Manager, Financial Planning

In response to the Covid-19 Pandemic, Congress passed and the President signed into law the CARES Act. The significant provisions regarding your finances are discussed here.

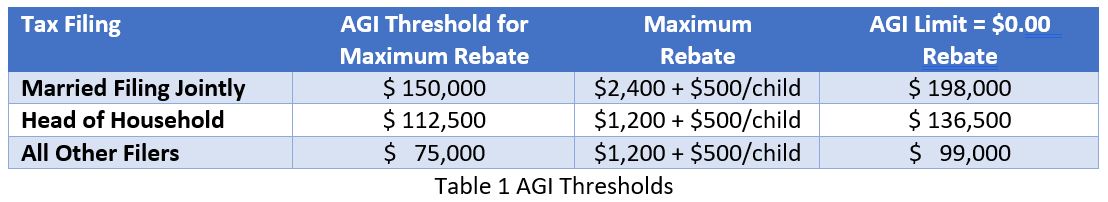

Recovery Rebates. You will receive a refundable income tax credit against 2020 income of up to $2,400 for married couples filing jointly. All other filers will receive up to $1,200. The amount increases by up to $500 for each child under age 17. The credit will be phased out by $50 for every $1000 over the adjusted gross income (AGI) thresholds. See Table 1.

Regular Unemployment Compensation increased by $600 per week. The benefit period for unemployment is now 39 weeks and you no longer wait one week before receiving benefits.

Coronavirus related retirement account distributions. The CARES Act will allow a penalty-free withdrawal of up to $100,000 per tax year from your retirement accounts for any person impacted* by the coronavirus.

- The distribution will be taxed over a 3-year period beginning in the 2020 tax year unless you opt-out and will not be subject to mandatory withholding requirements.

- You may repay the distribution to an eligible retirement plan where a rollover contribution can be made.

- You have three years from the day after the date the distribution was received to repay.

Required Minimum Distributions. The CARES Act has waived RMDs for 2020. This includes distributions that had to be taken by April 1, 2020 and Inherited IRA RMDs.

- If the 5-year rule applies to you, then the 5 years will be calculated without regard to calendar year 2020.

- If you have already taken your RMD for 2020 you have the option of returning it.

Qualified Plan Loans. If you are a person impacted* by the Corona Virus, the CARES Act has increased the amount you may borrow from your 401(k) from the lesser of $50,000 or ½ of your 401(k) balance to the lesser of $100,000 or your full vested amount. Any outstanding loans with repayment due by December 31, 2020 have been delayed for one year.

New $300 above the line deduction for charitable contributions. If your contribution is in cash, to certain types of organizations, not to a donor-advised fund and you choose not to itemize deductions, then you can claim this.

Payments for Federal Student Loans deferred until September 30th, 2020. Interest will not accrue during this timeframe. All involuntary collection related to the loan will be suspended as well. This includes wage garnishing, reduction of tax refund, reduction of other federal benefits and any other involuntary collection activity. The deferral will not have an impact on your credit rating or your ability to apply for loan forgiveness or loan rehabilitation in the future. Employers may exclude loan repayments from compensation.

*A person is deemed impacted by the coronavirus if any one of the following is true:

- You are diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention.

- Your spouse or dependent is diagnosed with such virus or disease by such a test.

- You experience adverse financial consequences as a result of being quarantined, being furloughed or laid off or having work hours reduced due to such virus or disease, being unable to work due to lack of child care due to such virus or disease, closing or reducing hours of a business owned or operated by the individual due to such virus or disease, or other factors as determined by the Secretary of the Treasury (or the Secretary’s delegate).

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum Wealth account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum Wealth accounts; and, (3) a description of each comparative benchmark/index is available upon request.