Markets React to New Variant

By Michael McKeown, CFA, CPA - Chief Investment Officer

Equity markets fell on the half day of trading on the Friday following Thanksgiving. The catalyst was the discovery of the new omicron coronavirus variant in South Africa. The World Health Organization designated it as a “variant of concern” on Friday.

It is early to handicap the effect and range of potential outcomes of omicron on the global economy. After poring over medical and statistical reports, most professionals are categorizing this variant as more mild compared to the delta variant.

On the other hand, it is too early to tell if vaccines will be effective against mutations in this variant. Pharmaceutical companies are ramping up development to combat omicron. Though in hindsight, companies did the same after discovering the beta and delta variants, which proved to be unnecessary given the effectiveness of the vaccine.

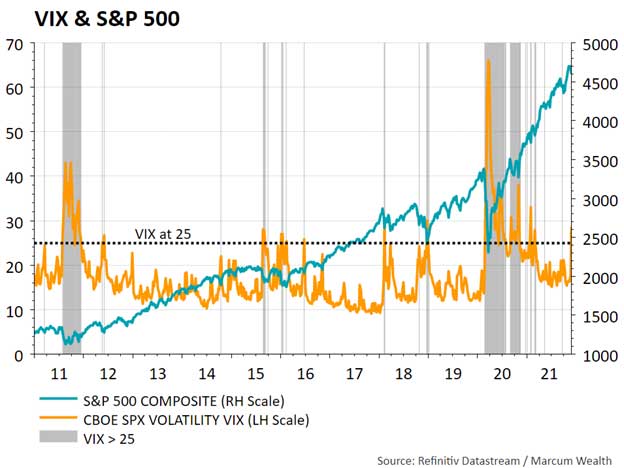

The equity market indices fell over 2% on Friday while the VIX Index (Volatility Index), a measure of the market’s expectations of volatility, jumped 40% to above 28. In the past, spikes in the VIX above 25 occurred around declines in the equity market. Often times, this was near the interim low in prices, while at other instances the market had more downside in the near term.

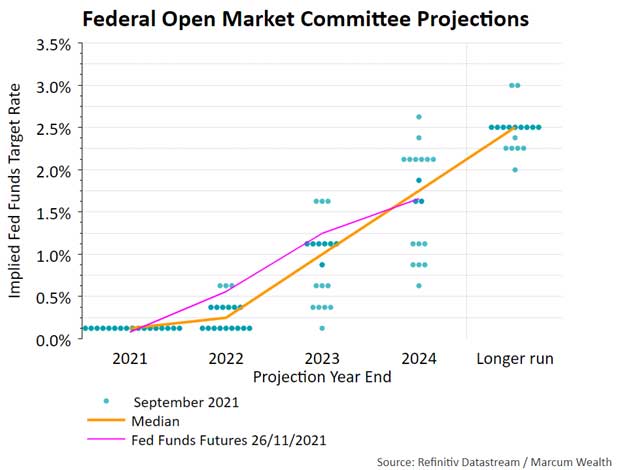

The bond market rallied as traders priced in less chance of three interest rate hikes in 2022. Bonds helped serve as ballast in this environment, despite many strategists saying there is no place for bonds with rates so low.

We will continue to monitor the new variant and how it may change the economic and market outlook.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.