What is the difference between the last two economic recoveries? In 2008, we had an implosion of the financial system. This time we had a shock outside of the system due to the pandemic.

Each cycle is different in its causes, conditions, and consequences.

In 2008, it took eight months until the government stepped in with programs and the Fed enacted emergency program.

In 2020, both the fiscal and monetary sides of the government responded in a matter of weeks.

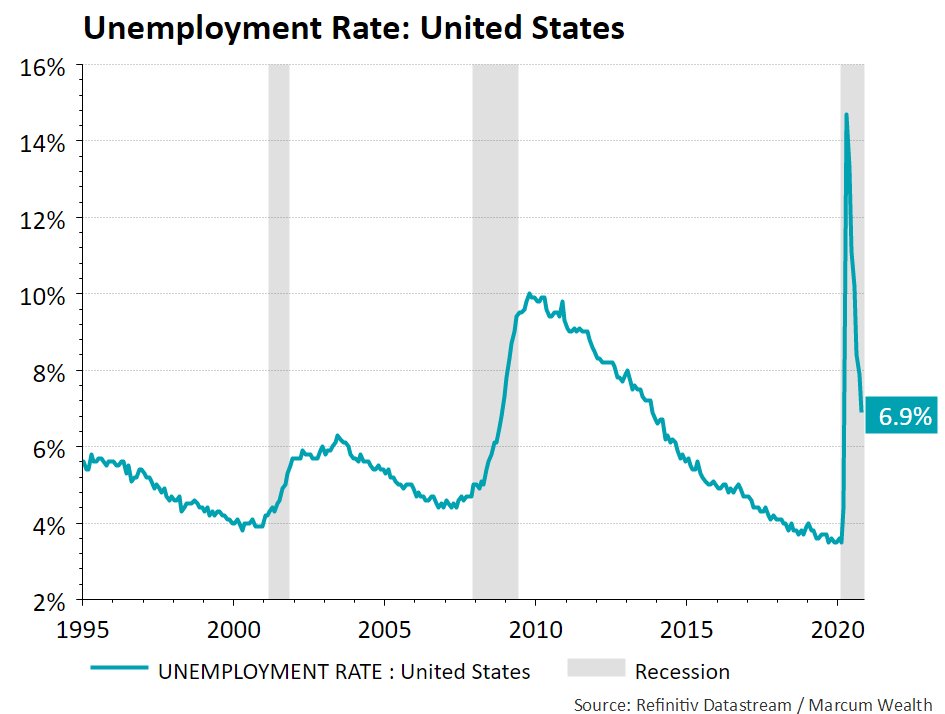

The labor market improved in the last four months as much as it did in four years following the 2008 recession. The chart below shows the sharp rise and fall in the unemployment rate.

Vaccine news continues to be positive. Some experts predict that by mid-2021, a large portion of the population will be vaccinated. The expectation being that the second half of 2021 will see a normalization of activity.

This bodes well for the unemployment rate, which should continue to fall. It is already at the levels of late 2013 when compared to the last economic recovery.

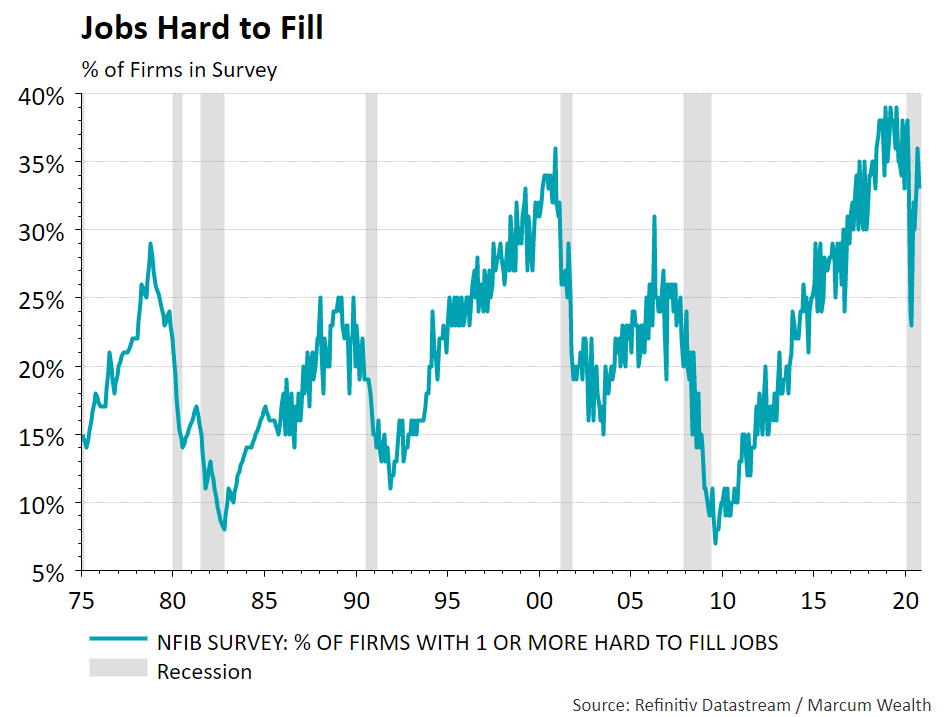

This likely means the labor market is going to be challenging for some employers, sooner than the last cycle. As shown in the next graph, about one third of companies are having trouble filling positions. This is near the highest levels seen in the last half-century.

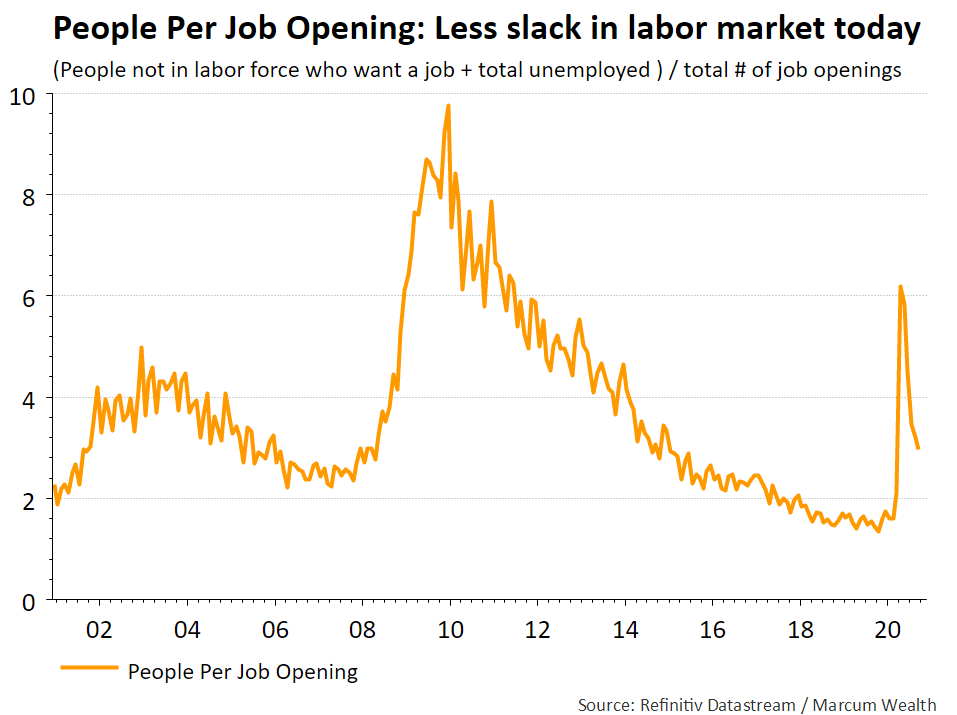

While there were 8 job-seekers per job opening following the last recession, now there are only about 3. This indicates tighter labor supply available to companies.

If the labor market remains tight and continues improving as expected, we can also expect to see wage growth. In turn, this could trigger inflation and put pressure on the Federal Reserve.

The Fed’s new policy framework allows inflation to run hot (above the 2% target for a period of time, to make up for the shortfall in recent years). There are tools the Fed can use to keep a lid on interest rates if inflation begins to surprise on the upside sooner than later.

While the future can always bring surprises, the current path looks promising for the economic recovery.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth's current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; ( 2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.