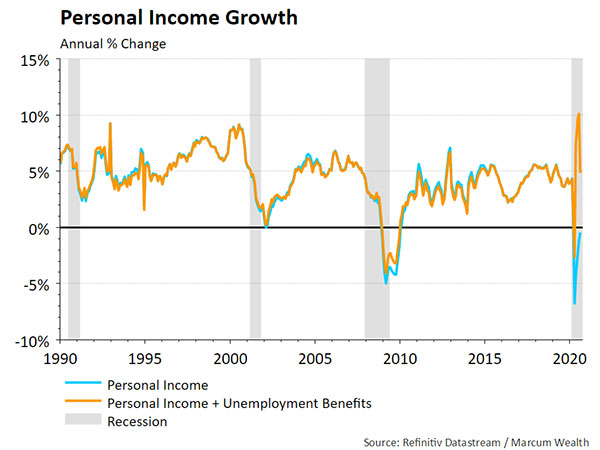

More fiscal stimulus is on the table after over $3 trillion was spent earlier this year. The plugging of the income gap for households and businesses was a key to the swift recovery. While income fell even more than in the 2008 recession, the transfer payments from unemployment benefits helped income to actually rise.

The 12.6 million people unemployed in the latest Employment Situation Report rely on these transfer payments. In turn, these payments lead unemployed households to support businesses with the goods and services they purchase.

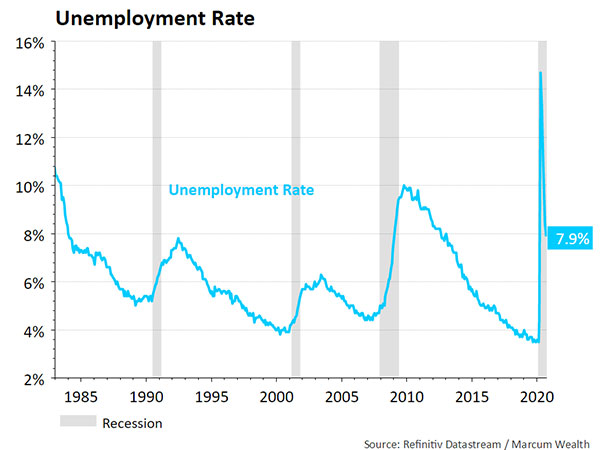

The economy continues to improve from the depth of the COVID-19 recession. Unemployment fell from a peak of 14.7% in April to 7.9% in October. This is the same level of unemployment the economy was at the end of 2012, over three years after the last recession ended.

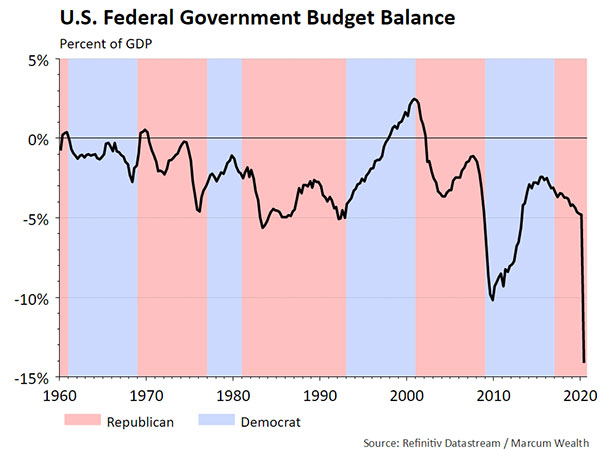

With many of the stabilizing policies set to expire, the Senate race becomes more important. The control of the Senate will determine whether or not the President for the next term will have a helping hand for the next stimulus package.

Currently, Republicans control the senate with 53 seats while Democrats have 47. There are 23 Republican seats up for reelection and 12 on the Democratic side.

It seems unlikely that a fiscal package will be enacted prior to the election. The last week has seen plenty of posturing and discussion of a bill in the $1.6 to $2.4 trillion range. The new baseline for expecting an agreement moves to post-inauguration in February. So far, markets shrugged off the delay.

In the big picture, fiscal policy is set to become more important. The Federal Reserve pushed monetary policy near the limit. This includes moving interest rates to zero, asset purchases, and many programs supporting markets. Federal Reserve Chairman Powell’s latest comments essentially said fiscal policy needs to step up and “don’t worry about over doing it.”

Last week, Cleveland Federal Reserve President Loretta Mester stated, “I’ve built a package into my forecast of continued recovery & certainly, the recovery will continue without it, I think. But it’s going to be a much slower recovery and it’s disappointing that we didn’t get a package done.”

This discussion is a major regime change from the past. Previously, Congress and both sides of the aisle were averse to expanding deficits. Though it is clear both sides are willing to expand deficits when in control of the White House.

The recovery was swift thanks to the fiscal action, getting us to an unemployment rate three years faster than following the Great Recession. Americans seeing that this is about willpower to combat recessions, and not ability, it may be difficult to put the fiscal genie back in the bottle in future recessions.

The worry with the shift to a greater emphasis on fiscal policy comes to inflation. Deficits do not lead to inflation, directly. Japan is a clear example. Spending beyond the productive capacity of an economy is the risk. With unemployment so high currently, there are productive resources available that are idle. The ability to change policy as the economic environment dictates will be important in the future.

For bonds, the current environment is keeping yields low. For stocks, it has led to growth outperforming as technology and healthcare sectors have longer dated cash flows, which benefit from low rates. Inflation expectations rising could be a catalyst that changes these trends. Over doing it on fiscal policy in the future would likely lead to inflation turning upwards.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth's current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; ( 2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.