The Case For and Against Inflation

By Michael McKeown, CFA, CPA - Chief Investment Officer

Ever since Federal Reserve officials described inflation as ‘transitory,’ the debate has swirled: Is the economy going to see runaway inflation due to massive stimulus, or will it be a short-lived event? (After all, the economy only reopens once.)

The case for ongoing inflation has several votes in its favor.

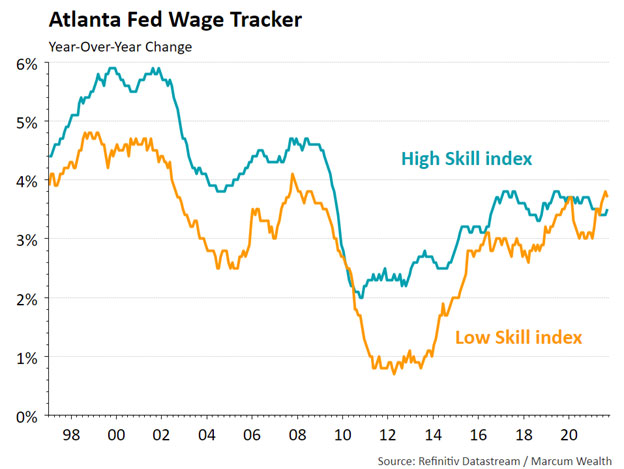

Today, businesses cite attracting and retaining people as their top challenge due to a low supply of labor. Wages are finally growing nationally, approaching 4% year-over-year growth according to the Atlanta Fed Wage Tracker. As the economic cycle continues, this wage growth may continue.

Supply chain issues are challenging businesses and consumers alike. Delivery times for items like furniture seem to keep moving further out. Ships delivering goods in ports have to wait weeks to unload. Components that go into electronic devices and cars are difficult to come by, pushing end-product prices higher.

Since we see these issues every day in the news and our own lives, it seems inevitable that inflation is here to stay.

There are, however, factors pushing against inflation.

The latest data for the consumer price index (CPI) rose 5% year-over-year. About 1.5% of this was due to an increase in energy prices — particularly oil, which rose from about $40 per barrel a year ago to $85. It is hard to fathom oil doubling again over the next year. The pace of increases seems likely to slow as producers respond to higher prices with a greater supply of oil.

Many of the ‘reopening’ categories, like airfare prices, rental car rates, and food away from home, rose rapidly in the last year. This contributed another 1% to the 5% increase. This also seems unlikely to keep pace with the torrid rate of the past year as things return to normal. The rest of the increase in CPI was due to ‘non-reopening’ categories rising 2.5%, which is average.

The trillion-dollar government stimulus plans grab headlines, but the spending would be spread over the next 10 years. Goldman Sachs expects the government fiscal deficit to increase only 0.5% in 2022. This would have less of an inflationary impact than the news would suggest.

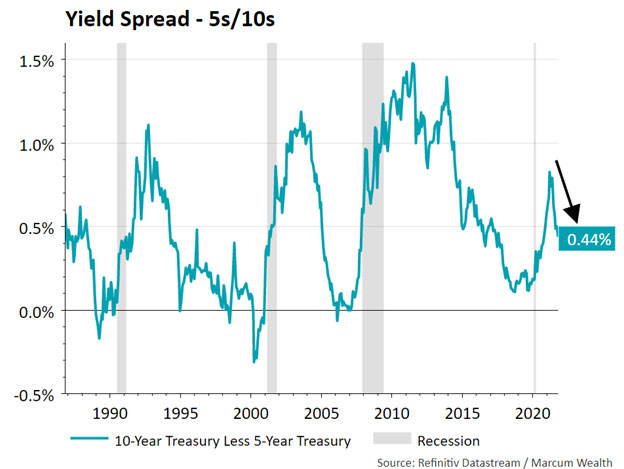

Finally, the bond market is not sounding alarm bells. If anything, the inflation premium is falling. While it is a simple metric, the yield curve spread between the 5-year Treasury and 10-year Treasury has fallen steadily since March. This is a sign that those with money on the line see inflation and growth rates falling rather than increasing as policy becomes tighter (due to tapering of asset purchases and increases in short-end interest rates).

There are plenty of narratives and data to back up either take on inflation. The next few months will offer a much better idea of which side is right.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.