We all know a tourist trap when we see it. The entire purpose is to attract people and their money. Locals know it is not worth the price. Yet people still show up for the experience.

There are tourists in the investment markets as well. People stop by an area they do not usually venture. Usually the price is not worth the experience.

The locals (traders and market pros) do not usually partake. Typically there are better ways to get the experience (or market exposure).

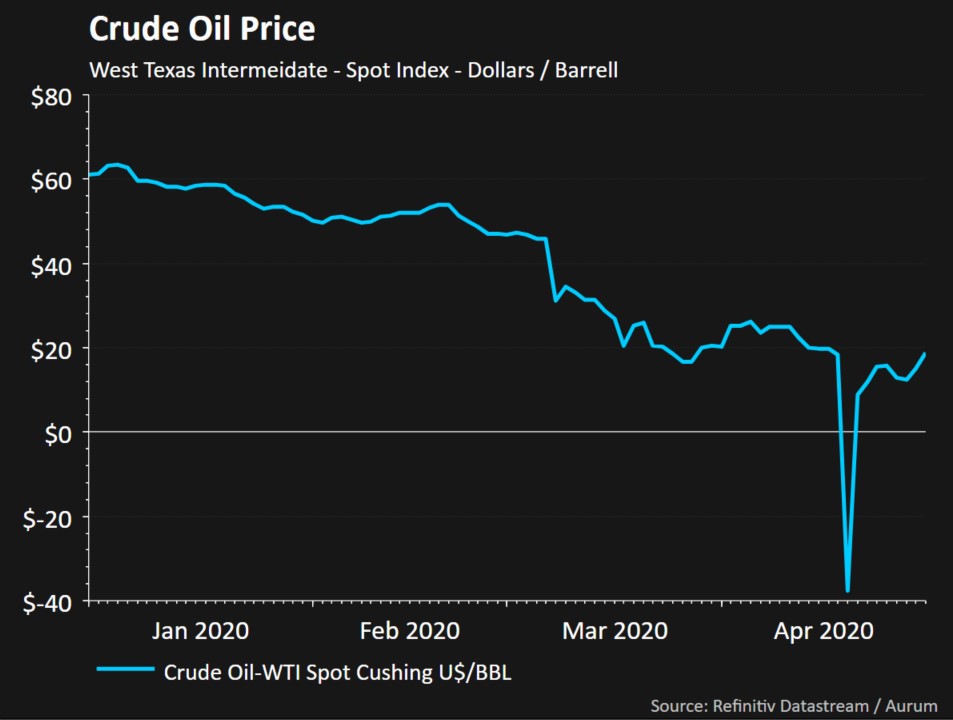

With oil prices dipping to $20 a few weeks ago, nearly every non-professional investing friend I talked to wanted to figure out how to buy oil or oil stocks. The price was already down 67% from the start of the year. How low could it go?

Turns out, even lower.

---

At the start of each year, our CFA Society of Cleveland has a forecasting contest. Members forecast the price of stocks, bonds, and oil. In 2014, oil started at $98 and ended at $53. Out of over one hundred members, I was the winner. My guess: $87. And it was closer than most of the Wall Street banks.

This told me that almost no one had any idea or model for predicting the price of oil. It also made me very open to prices moving farther and in greater duration in either direction. When I saw a forecast in early April for prices to end the year at $5 to $10 per barrel, I thought it was extreme; but plausible.

Even that was optimistic.

Prices fell negative last week due to oil storage being at capacity.

Now theoretically, one could buy a barrel of oil and sell it later. Though storage costs are not cheap. And one does not want to actually take delivery of oil. The vapors from the hydrogen sulfide produced by oil could kill within a few seconds. [See: That Time I Tried to Buy Some Crude Oil]

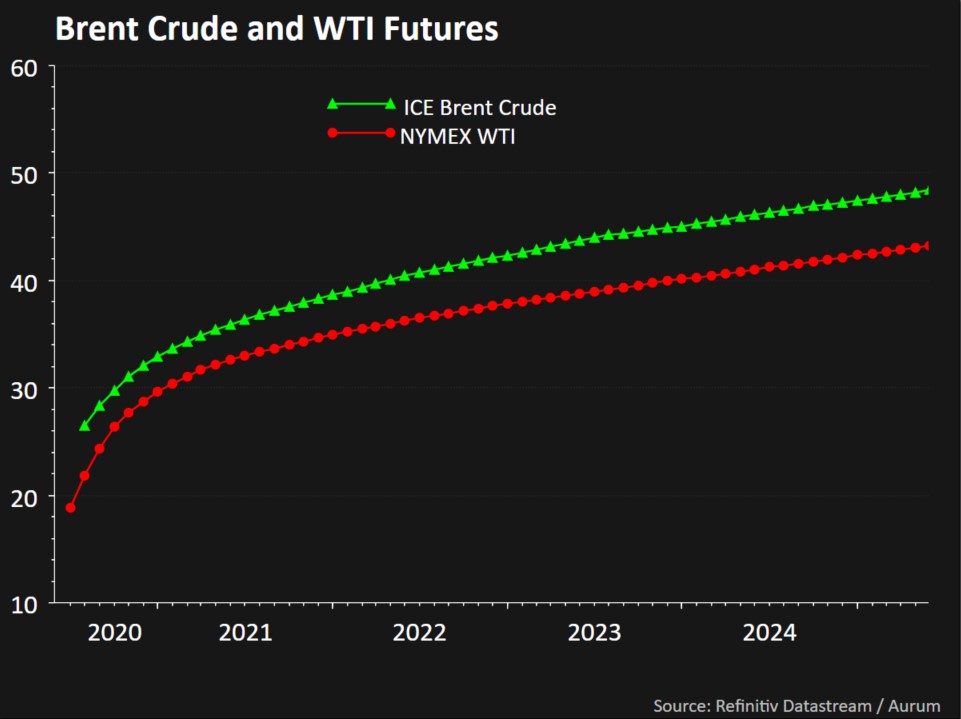

In addition, the view that oil prices would go up is not different than what the market believed. The futures price for oil was much higher. To make money, the price must rise more than the market forecasts.

However, investors in the oil ETFs had exposure to the front-month contract. So expressing the view in these products as they continuously roll over the front-month contract may not actually work as they think. In the last week, products and indices tracking the price of oil changed the approach to try not to be gamed by traders (locals).

---

Investment products with derivatives add a layer of complexity that is difficult to understand. Products that traded off the volatility of the stock market became popular last decade. Investors could bet on volatility going up or going down. In February 2018, those betting on falling volatility blew up and the products ceased existing.

Wall Street creates a lot of products claiming the ability to give 'access' to investors. Yet it often brings a black eye to the industry. Much of the time these products turn out to be tourist traps for investors. Usually they do not work as the buyer intended and it is not worth the experience.