Chart of the Week

Plenty of negativity from investors may be priced into stocks. The markets do not move on good versus bad news overall; movement is relative to expectations. News that is bad, but slightly better than expected can be received well. If sentiment gets too negative among investors, just glimmers of hope can turn the tide.

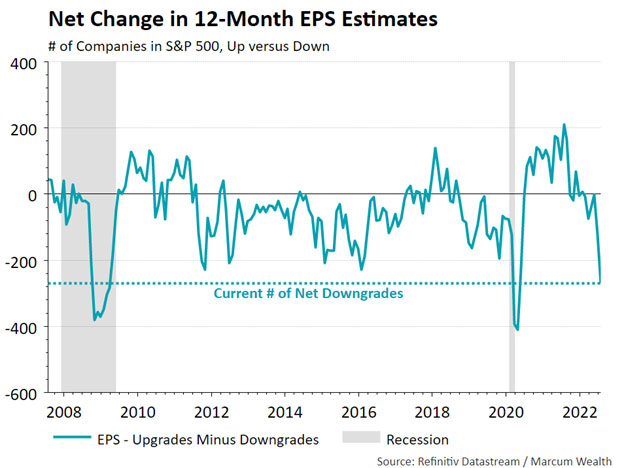

Over the past month, the number of companies with lower earnings estimates was seen only twice in the last 15 years. This happened in late 2008 and in 2020, both periods that included deep drawdown in equity prices. The bar has been lowered quite a bit. Today, 269 companies have seen analysts decrease estimates for earnings over the next 12 months. With earnings this past quarter surprising on the upside, perhaps the time for better news is here. So far, 75% of the market value of the S&P 500 Index reported results this quarter. According to Goldman Sachs, earnings increased by 9% on a year-over-year basis with revenue growth across all sectors.

What We’re Reading

I Beg to Differ – Oaktree

How Inflation Is Impacting Commercial Real Estate – Green Street

Road Ahead: The 60/40 Portfolio, Bear Markets, and Recessions – Man Institute

What is the Federal Reserve and How Does it Work? – Morningstar

Senators Press Fidelity on Bitcoin Exposure – Plan Sponsor

Podcast of the Week

Five Big Issues Top Washington’s To-Do List – Washington Wise, Schwab

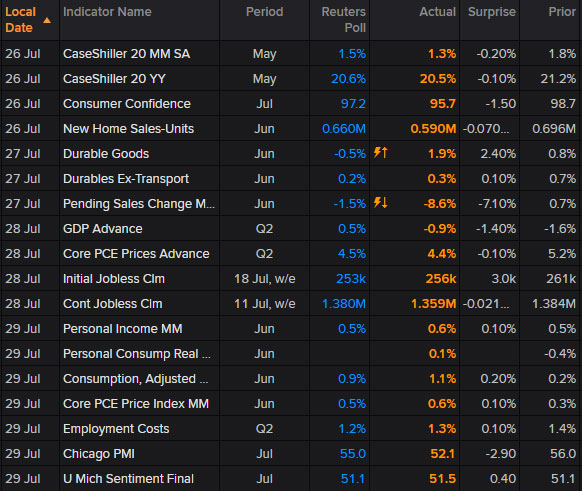

The Past Week

The Federal Reserve Open Market Committee increased interest rates by 0.75%, as expected. The Fed chairman, Jerome Powell, indicated that the pace of interest rate hikes would slow in the future. This news catalyzed equity markets higher and bond yields lower. The estimate for second quarter GDP came in below expectations and was the second straight quarter of negative growth. Of course, this GDP report will be revised in the months and quarters ahead as more accurate data become available. Earnings came in above expectations for large cap technology companies reporting last week.

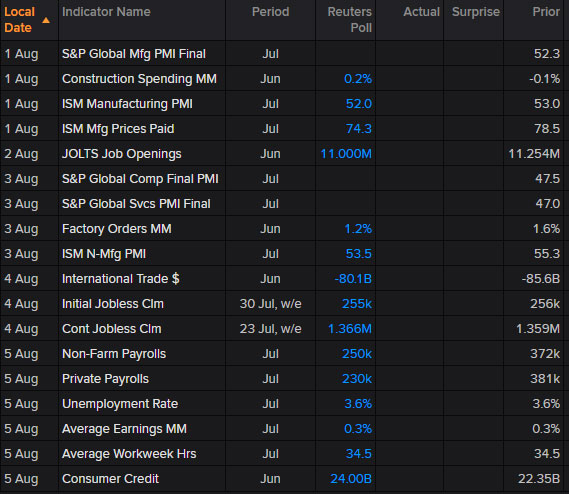

The Week Ahead

On deck this week are reports from Standard & Poor’s and the Institute of Supply Management. Jobless claims trended higher the last few weeks, so July payrolls along with the revision to June will be a key data point. This week has another heavy list of earnings reports including from chip maker Advanced Micro Devices.

Talk to you next week.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.