Chart of the Week

“Economists have predicted nine of the last five recessions.”

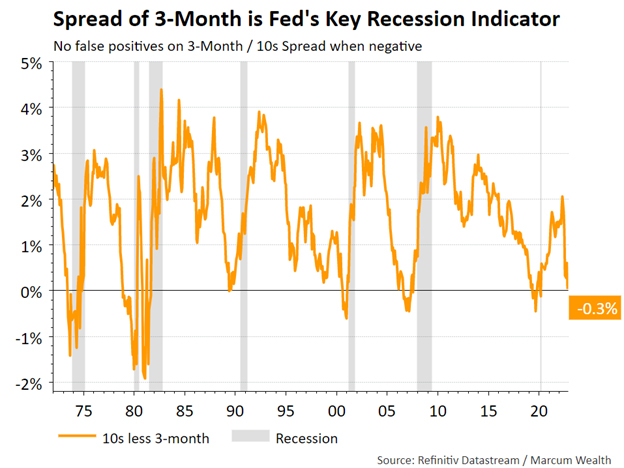

It is an old line that refers to economists issuing more warnings than truth when it comes to an economic outlook. We discussed the inversion of the yield curve, which means that longer dated Treasuries are yielding less than short-dated Treasuries. Various parts of the curve were inverted earlier this year, but a key one just flipped. Researchers at the New York Federal Reserve noted that the 10-year yield being below the 3-month Treasury bill occurred prior to all of the recessions in the past. While there is hope the economy can void this outlook, it may be the most telegraphed economic downturn in history.

What We’re Reading

A Few Good Stories – Morgan Housel

Trading Secrets: The Fed’s Monkey Business – TCW MetWest

Why holiday shopping is starting even earlier – JLL

5 Mindsets That Create Success – Mark Manson

Podcast of the Week

Juliette Declercq Sees Inflation Peaking & a Decent Economy – On the Margin

The Past Week

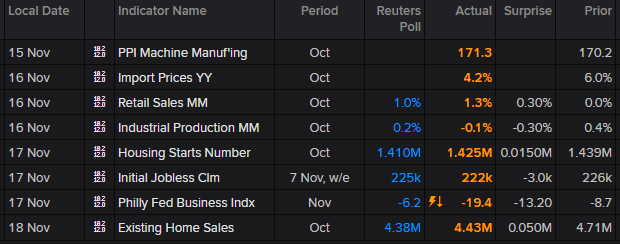

On Monday, the Chicago Fed’s National Activity Index showed continued expansion for the economy through October. Retail sales surprised on the upside. Housing starts continue to come down but were above expectations. Industrial production and the Philly Fed Business Index showed a contraction.

The Week Ahead

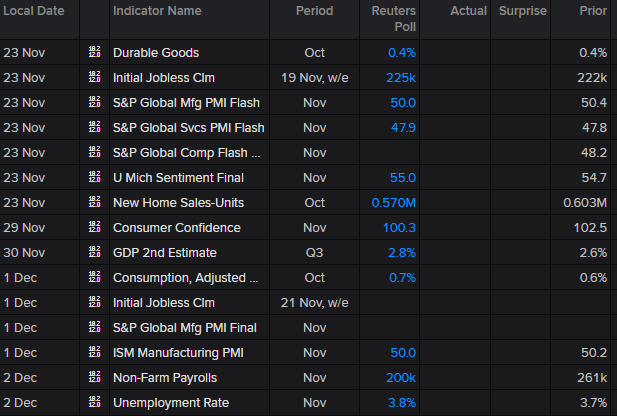

With the holiday shortened week, we will look out over the next two weeks. Durable goods and the Global Purchasing Manufacturing Index reports will give us the last big data points before the holiday. Next week the consumer confidence and jobs reports will be the most widely followed.

We hope you have a Happy Thanksgiving. We will be back next on December 6th.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.