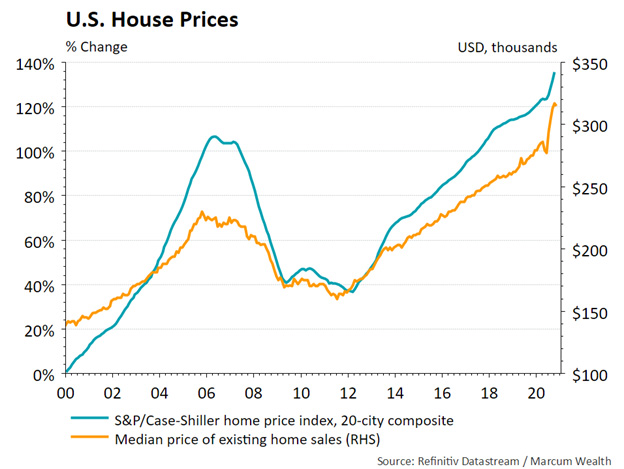

The housing outlook for 2021 benefits from strong momentum in 2020. Last year, home prices rose 8.4%. Low inventory of homes for sale was a key driver. Strong demographic trends also contributed as more millennials reach peak home buying ages.

The median home price climbed from $279k at the start of 2020 to $317k at the end of the year. Zillow forecasts home prices to rise 10.5% over the next year.

Many worry about another bubble in home prices. Yet builders have not constructed homes near the pace of the 2003 to 2007 period. In addition, the process for obtaining loans is much more difficult today than in the last cycle. Ask any mortgage applicant how much documentation is needed now.

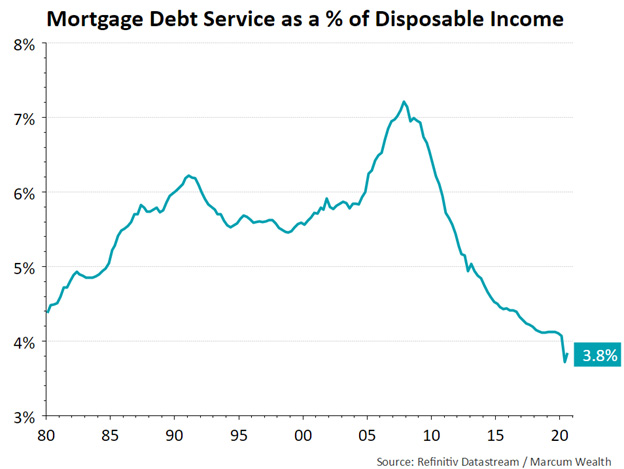

While prices climb, affordability looks reasonable. Household income grew during 2020, despite the rise in unemployment. Lower interest rates allow for reasonable payments. Interest payments as a percent of disposable income hit a 40-year low.

Technology trends accelerated during the pandemic. The CEO of Microsoft said the pandemic pushed “two years of digital transformation into two months.” From Zoom meetings to food delivery, more activity happens online.

For home buyers, the acceptance of 3D tours continues gaining acceptance. This may serve as an initial walk-through for a home, helping buyers and agents improve efficiency. In turn, this lowers the amount of time homes sit on the market for sale.

A positive outlook for housing into next year remains. Higher interest rates could be a factor that slows prices. Monitoring how homebuilders pace the new supply of homes is key over the long-term.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; ( 2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.