Coronavirus & Markets Update

By Michael McKeown, CFA, CPA - Chief Investment Officer

Global equity markets sold off by 3.5% on Monday as investors reacted to more news on the Coronavirus. The S&P 500 Index was at all-time highs three trading days prior. Safe havens, including gold and treasuries, climbed in price.

The concern for human health and life is, of course, the most important aspect of this tragedy. Still, to the extent it affects daily activity, it does have a real economic impact.

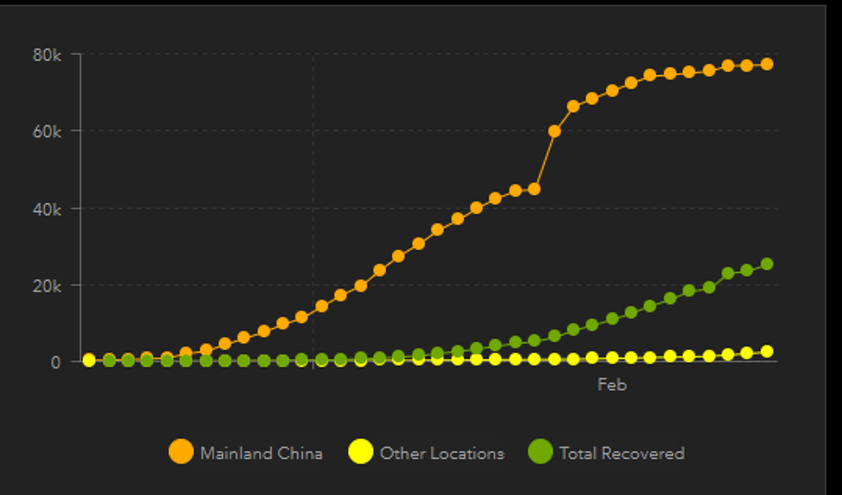

Cases have been rising in China throughout the past two months. Apple announced last week that its supply chain would be disrupted. It took the announcement of 7 deaths in Italy for investors to respond this week. Investors fear that supply chains in Europe could also be affected if the virus spreads. More cities on lockdown around the world would lower growth expectations further. Travel restrictions and other measures are already affecting many people and businesses.

Source: John Hopkins University

Many market strategists are comparing the current virus outbreak to previous episodes, such as SARS in 2003 in China. We have looked at models comparing past outbreaks and pandemics with market performance but know that history does not always repeat itself. The sample size of similar outbreaks is small and we recognize this as an ‘unknown, unknown.’ The severity and duration of the coronavirus cannot be predicted by the past.

This strand of the coronavirus is similar to influenza viruses. According to experts, however, what makes Coronavirus unique compared to more recent outbreaks is that its symptoms do not become apparent for many days. This allows the potential for greater infection among the population. Still, the fatality rate is less than 2%. Many governments and companies are working on a vaccine; however, it would likely take over a year to produce, even if it was viable.

The number of confirmed cases in China has begun to plateau. Of course, many suspect the data reported from China may be understated. It may be weeks or months before data from around the world also begins to slow down. There has been an increase in the rate of recovery, a clear positive.

Source: John Hopkins University

What are investors to do?

Even if we knew the dollar amount that earnings would fall due to the Coronavirus, it does not mean there exists a timing tool to get in and out of the equity markets profitably.

On average, stocks experience a 13% peak to trough fall in prices every calendar year. The reasons vary.

The year-to-year return premium that stocks offer over bonds is quite volatile. We can see calendar year results of down 50% to up 50%. Investors earn those long-term returns of 10% from stocks for enduring the year-to-year volatility.

The long-term value in stocks is in the terminal value of businesses. This value is mostly attributable to cash flows and earnings from greater than five years out. The short-term business results matter, but not as much as the results further out. As Ben Graham said, “In the short-run, the market is a voting machine. In the long-term, it is a weighing machine.”

Building liquidity into portfolios for times like these is important. Our mantra the past few years has been to ‘make sure bonds act like bonds.’ What this means is that we want the bonds in portfolios to be available to rebalance into stocks when those depressed prices inevitably come about. We do not want to see bond portfolios selling off in tandem with stocks. High yield bonds were down 1% on Monday and would be an area to consider if yields increased.

Our objective is maintaining flexibility while sticking to investment plans. This includes dollar-cost averaging and prudent rebalancing. Our historical data and analysis show the process works, and it remains our focus.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum Wealth account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum Wealth accounts; and, (3) a description of each comparative benchmark/index is available upon request.