Putting Psychology into Action

By Michael McKeown, CFA, CPA - Chief Investment Officer

Asset price bubbles are not a recent phenomenon. The Dutch Tulip Mania in the 1600s happened when the rich chose to drive up the price of tulips to astronomical levels. They collected tulip bulbs and hoped to sell them to the next greatest fool. It eventually popped.

In the 1700s, the South Sea Bubble in Britain created massive wealth for shareholders when the prices of the South China Sea Company went up 8-fold. Those same shares collapsed and created an economic crisis.

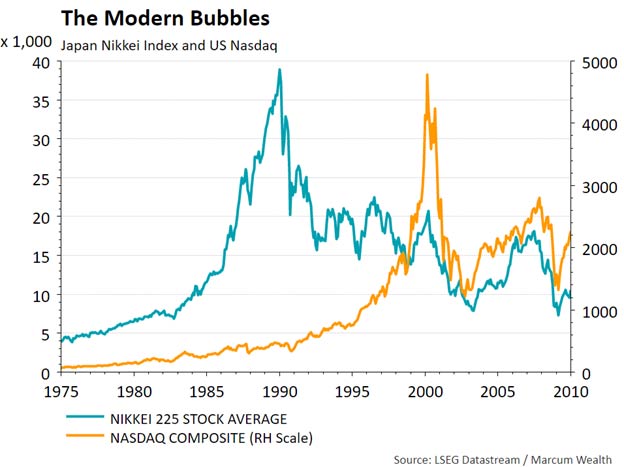

In modern times, the Japanese stock market bubble peaked in 1989 and fell 80% over the next 20 years. In the United States, the late 1990s technology bubble witnessed the Nasdaq falling by 80%.

In hindsight, it is safe to say that the prices in these periods were driven not by deep research and analysis. It was the madness of crowds, a compelling story, and greed.

Before the 20th century, economists believed the human mind, emotions, and behavior had no place in economics. The core assumption of economics at the time was that human beings always act rationally. The basis of all decision-making assumed we did not have a flawed, emotional 250,000-year-old operating system in our heads. To old-school economists, our brains were rational actors.

We now know that this is not the case in the real world.

Daniel Kahneman, the “grandfather of behavioral finance” and Nobel Prize winner, passed away last month at the age of 90. His research from the 1970s and 1980s formed the basis for bringing psychology to the field of economics.

This was revolutionary compared to prior standards.

As Jason Zweig summarized Daniel Kahneman’s work in his column, “The Psychologist Who Turned the Investing World on Its Head,” Danny answered questions about “Why do we sell our winners too soon and hang onto our losers too long? Why don’t we realize that most hot streaks are just luck? Why do we say we have a high tolerance for risk and then suffer the torments of the damned when the market falls? Why do we ignore the odds when we know they’re stacked against us?”

Kahneman and the behavioral finance acolytes brought attention to the biases that afflict humans when it comes to money. This includes but is not limited to:

- Loss aversion – losses hurt more than gains feel good.

- Overconfidence bias – overestimating our knowledge causes excessive trading and risk-taking.

- Anchoring bias – relying too heavily on specific information or our original position.

- Herd mentality – the tendency for individuals to follow a larger group to take action on specific markets or positions.

- Disposition effect – the tendency for investors to sell winners too soon and hold onto losers to avoid taking a loss.

This is great to know and informative, but how do we use it and put it into practice when investing? A listener asked this question to my colleague Alex Sterba when he hosted a behavioral finance webinar a few weeks ago in our ongoing “Plan to Make It Happen” series.

First, being aware of the biases can help us avoid mistakes when the stakes are high. An example of this is herding. We want to belong and go with the group, which can make us aware of a mania pulling all kinds of people into it. If it is driven by a narrative rather than fundamentals, caution would be warranted.

A second way is diversification. We use diversification in two different ways. First is diversifying across asset classes – equities, bonds, alternatives, and cash. Each provides key sources of returns and risks for an overall portfolio: Stocks (growth), bonds (income), alternatives (differing risk exposure), and cash (optionality for future opportunities).

In addition, we are diversifying inside each asset class. While passive index exposure can make sense in certain asset classes, it may not be the best way for bonds. The most widely followed bond index is the Bloomberg Aggregate Bond Index. Yet it covers only half of the US bond market. It excludes areas like municipals, securitized bonds, and many corporate credits. Sizing each holding at the right percentage weight is critical here. That way, when one fund or manager’s style is out of phase, you can rebalance back into these strategies.

A third way is rebalancing. A systematic process for both buying and selling helps alleviate the herd mentality. We use strict and data-driven guidelines for when those rebalances will occur. Price levels in the market or a percentage from the allocation, rebalancing guidelines can help lower the timing luck and avoid getting too concentrated or too underweight to strategic targets.

A fourth way is overcoming the endowment effect. When making a financial plan, we often find that investors are not positioned to achieve their long-term goals. But change is difficult! We want to avoid the endowment effect. This is when investors tend to be overly enamored with what we already own, even when evidence is shown that we should change. By providing the catalyst for changing a portfolio, we can help get into the proper asset allocation based on the financial plan.

The fifth and final, at least for today, is an information filter. We understand there are a lot of opinions and loud voices on CNBC, Bloomberg, and the Wall Street Journal. Fortunately, we don’t have to act on them. Even better, it helps to not listen to most of them at all. Many have agendas to push anyway.

In the end, our psychology often works against us. But it does not have to. It starts with a well-established financial plan that outlines goals, risk tolerance, and the investment strategy to achieve this. Having a clear plan can help you stay focused and avoid making emotional decisions that do not align with the long-term strategy.

Important Disclosure Information

Marcum Wealth, LLC (“Marcum”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply a specific level of skill or training. A copy of Marcum’s current written Disclosure Brochure discussing its advisory services, fees, and material conflicts of interest is available upon request.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum), or any non-investment related content, made reference to directly or indirectly in this communication, will be profitable, equal any corresponding historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Certain strategies and vehicles referenced in this communication, such as private investments, Opportunity Zones, and ESG investing, may present increased or novel risks, including potentially higher management fees, reduced liquidity, shorter performance histories, or increased legal or regulatory exposure, compared to more traditional publicly traded securities and investment strategies. All investors should consider these potential risks in light of their individual circumstances, objectives, and risk tolerance. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. The asset allocations reflected in this communication are targets only. Actual allocations can and often will deviate from these targets, including in instances of volatile markets, large deposits or withdrawals, or during account rebalancing.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and (3) a description of each comparative benchmark/index is available upon request.

Not all services described herein will be necessary or appropriate for all clients. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. The potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances, and overall objectives. Neither personalized services nor financial or professional resources or processes should be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.

If you are a Marcum client, please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify/advise us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. Tax and accounting services provided by Marcum, LLP. Insurance services provided by Marcum Insurance Services, LLC.