The global events of the past month are moving fast. It might be surprising that financial markets are taking all of it in stride, so far.

The stock markets outside of the US have struggled over the past few decades. Too much debt, poor demographics, slow policy responses, and less innovation are all culprits. But a change in leadership just happened.

The UK FTSE Index and the German DAX are the two largest European markets. Both hit all-time highs this past month. France’s CAC Index is just shy of its 2024 peak.

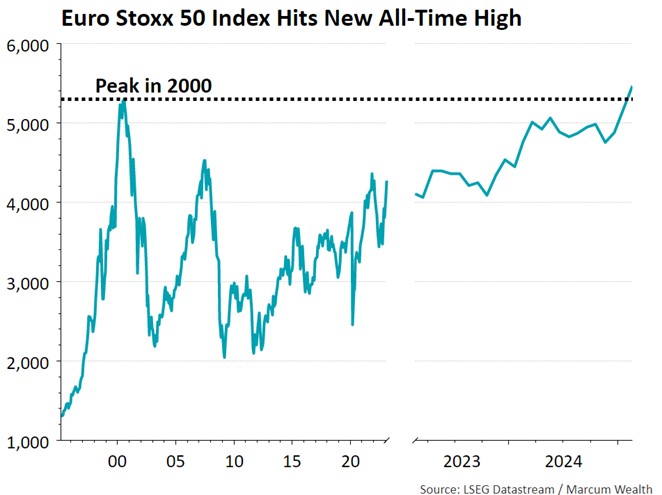

The MSCI Europe Index came into the year at a value of $11 trillion. The concentrated Euro Stoxx 50 Index took 25 years, but it finally beat out the price highs from the year 2000.

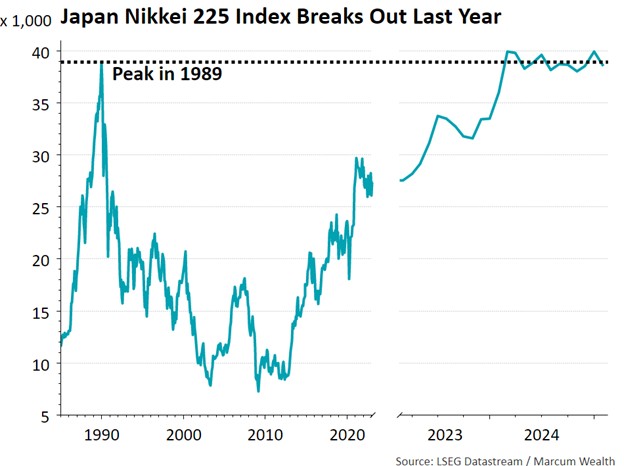

Not to be outdone, Japan took a 35-year hiatus from its all-time highs. In 1989, it was the largest stock market in the world, above that of the US. Today, it is just under $4 trillion, or worth a little more than one of our top technology companies. It just surpassed the 1989 levels last year, though it is having a difficult time making durable highs above those made in June of 2024.

Looking at the credit markets to see if bond investors are on the same page as equity buyers can be helpful. We can see spreads are low, indicating fewer potential defaults.

High-yield corporate bond spreads are below 4% for only the second time in the last 15 years. This last occurred in 2018 for the four major markets shown below (US, Europe, Asia, and Emerging Markets).

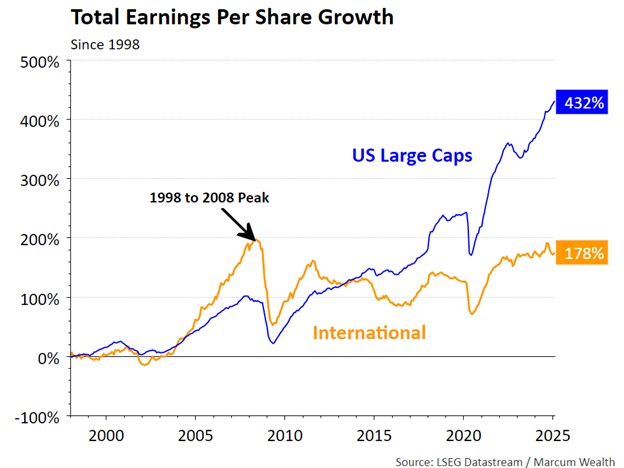

Whether the latest outperformance against the US can continue for international markets will come down to several factors. The number one in our eyes will be if earnings can grow faster. Earnings per share growth on a relative basis has been the factor with the best tie to stock market performance. This peaked in the ten-year period ending in 2008 for international while the US outperformed sharply since.

The US market has been led by Magnificent seven companies, all of which have big profit margins and fast growth. On the other hand, less fiscal spending over the coming years could be a headwind for US earnings. In addition, the concentration of US markets in a handful of technology companies focused on a narrow theme of artificial intelligence cuts both ways. If the pace of growth disappoints investor expectations, then we could see a rotation in money flows.

Europe, meanwhile, may have to spend up to $3 trillion over the next decade on defense spending according to a recent Bloomberg article. The aerospace and defense industry in Europe is up 150% over the past three years, beating the Euro Stoxx 600 Index which is up 34%. As European countries lived through tight budgets for most of the time since 2010, it might be time for it to expand.

For investors, this means diversification is finally back. While the other large developed markets may have taken a long nap, global stock markets moving at different speeds can be great for portfolios. It allows us to construct a more robust set of opportunities to participate in economic growth.

Important Disclosure Information

Marcum Wealth, LLC (“Marcum”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply a specific level of skill or training. A copy of Marcum’s current written Disclosure Brochure discussing its advisory services, fees, and material conflicts of interest is available upon request.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum), or any non-investment related content, made reference to directly or indirectly in this communication, will be profitable, equal any corresponding historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Certain strategies and vehicles referenced in this communication, such as private investments, Opportunity Zones, and ESG investing, may present increased or novel risks, including potentially higher management fees, reduced liquidity, shorter performance histories, or increased legal or regulatory exposure, compared to more traditional publicly traded securities and investment strategies. All investors should consider these potential risks in light of their individual circumstances, objectives, and risk tolerance. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. The asset allocations reflected in this communication are targets only. Actual allocations can and often will deviate from these targets, including in instances of volatile markets, large deposits or withdrawals, or during account rebalancing.

Not all services described herein will be necessary or appropriate for all clients. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. The potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances, and overall objectives. Neither personalized services nor financial or professional resources or processes should be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.

If you are a Marcum client, please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify/advise us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. All clients are advised individualized legal, accounting, and tax advice from the qualified professional(s) of the client’s choosing. Insurance services provided by Marcum Insurance Services, LLC. The recommendation by a Marcum representative that a client engage Marcum Insurance Services for insurance-related services or products, presents a conflict of interest, as the potential receipt of revenue by Marcum’s related party may provide an incentive to recommend Marcum Insurance Services for insurance-related services or products. No client is under any obligation to engage Marcum Insurance Services for insurance-related services or products.

Certain Marcum representatives are, in their separate capacities, accounting and tax professionals of CBIZ, Inc. (“CBIZ”), an unaffiliated certified public accounting firm. Marcum does not render accounting advice or tax preparation services to its clients. Rather, to the extent that a client requires accounting advice and/or tax preparation services, Marcum, if requested, may recommend the services of a qualified tax and accounting professional, which could include recommendations to engage Marcum personnel in their separate capacity as CBIZ accounting professionals. In addition, clients of Marcum may be charged a single bundled fee for investment advisory services rendered by Marcum and accounting and/or tax preparation services rendered by the client’s engaged accounting professional. A recommendation for a client to engage a Marcum representative in their separate CBIZ capacity presents a Conflict of Interest, due to the potential receipt of tax and accounting compensation by CBIZ and/or the Marcum representative. No client is under any obligation to engage a Marcum representative through CBIZ for accounting and/or tax preparation services. Marcum will work with the accountant of the client’s choosing.