The crisis in Ukraine continues to unfold as Russia advances its attack on the region.

The loss of human life is the first concern. It feels callous to talk about markets in perilous times such as this. Yet it is our responsibility on behalf of our clients to navigate financial markets.

I will not pretend to be a geopolitical expert. But I do read a lot.

Consensus among the experts seems to be that this will be show of force by Russia. A diplomatic response with sanctions by the US and our Allies is expected. The duration of the conflict is difficult to handicap as the range of possibilities is wide. It could be short or much longer. The risk has shifted from a possibility of conflict to the extent of conflict. It may be an orchestrated skirmish or far worse.

Equities are selling off globally. Every strategist cites geopolitical events and pandemics as risk factors that can impact equity prices in the year ahead. It is unfortunate we have witnessed both of these in such a short time frame. Over time, equity investors are compensated for these risks with a return premium over fixed income. The ride to achieve these gains is often volatile. But the volatility is the reason equity investors enjoy higher returns over the long-term.

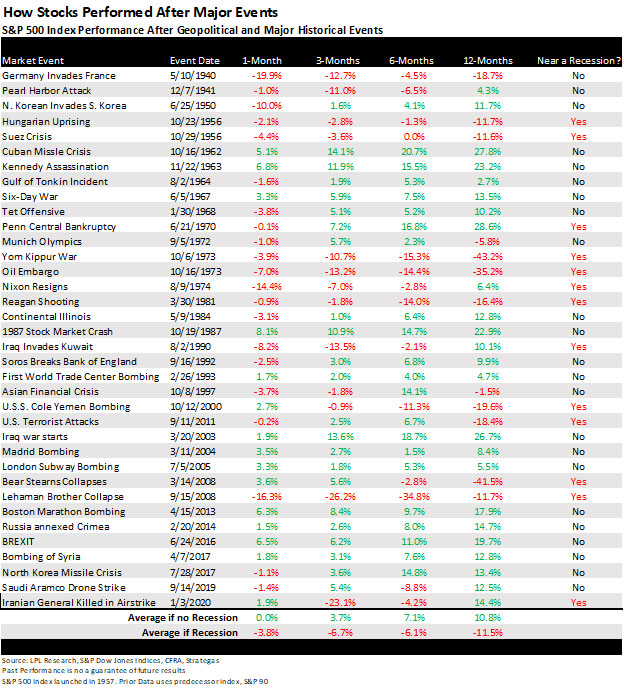

During past historical events, the equity market recovered outside of recessions, increasing nearly 11% over the next year. In events taking place near a recession, markets fell over 11%.

We are seeing the diversification provided by bonds and gold, helping ballast portfolios in the near term.

“We know we don’t know” is a phrase we have often said at our firm to approach problems with a humble mindset. We do know that forecasting events and market moves is nearly impossible in real time.

Fortunately, forecasting is not necessary for long-term investment success. Having a time-tested investment process is what gets investors through volatile periods.

Our investment principles do not change. Valuations matter and the price you pay is important. Momentum rules in the short term. Diversification works.

At the beginning of each quarter, our investment committee meets to discuss how we will respond to different market events. This accounts for both up and down markets. It has helped guide us through tumultuous periods in the past.

We have guidelines and benchmarks for taking action across equities and fixed income. We will respond as those thresholds are hit and trigger our plans laid out in advance.

We will monitor how the Ukraine conflict affects the economic outlook, consumers, interest rates, equities, and oil prices as more information unfolds. Fortunately, the U.S. economy is not reliant on this region for trade and energy prices should be less affected here than in Europe.

It is easy to become caught up in the price moves over the short-term as our financial resources come under price pressures. “Focus on the long-term” is a common phrase for investors, but it said for a reason – because it works.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.