Chart of the Week

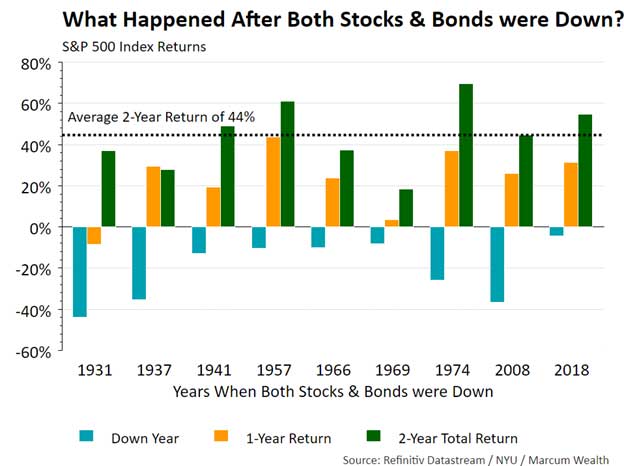

Markets are ready to put 2022 in the rearview mirror. For just the ninth time since 1928, stocks fell along with bonds (as measured by when either the 10-year Treasury or corporate bonds declined). Historically, the S&P 500 rose in the following year eight out of nine times. Over the following two calendar years, the market was up all nine times with an average cumulative gain of 44%. Past performance is no guarantee, of course, but there are parallels. The years below coincided with three types of economic environments: the beginning of a recession; the middle of a recession; and the middle of a growth cycle. Each of these U.S. economic scenarios occurred three times each. There is much debate as to whether this economic slowdown will turn into a recession or if a soft landing still has an outside chance.

What We’re Reading

Where Have All the Workers Gone? – Sage Economics

2023 Outlook: The End of the Affair – JPMorgan, Eye on the Market

Ten Economic Questions for 2023 – Calculated Risk

We Are Heading into a Great Environment for Emerging Markets – The Market

Reciprocity: Getting What You Give – Farnam Street

Podcast of the Week

Inflation Will Fall off a Cliff in 2023 – The Macro Trading Floor

The Past Week

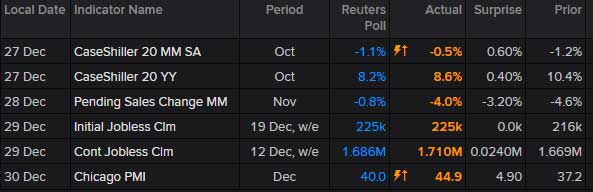

It was a quiet holiday week for data. Housing was the main event as pending sales dropped more than expected. The Case-Shiller Price Index, which tracks national home prices, fell for the fourth straight month. Most housing analysts see a decline in national home prices this year due to the lack of affordability.

The Week Ahead

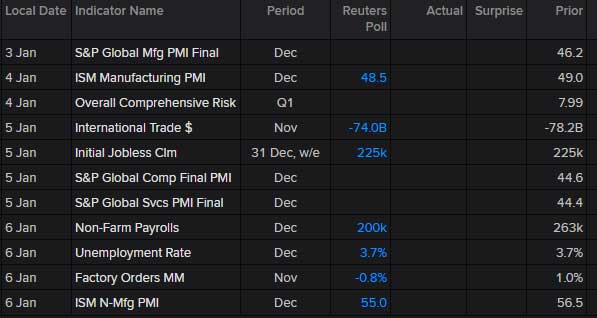

Data starts out the year hot like the unseasonably warm weather. We will see how the U.S. is doing on both the services and manufacturing sides. On Friday, all eyes will be on the jobs report.

Happy New Year!.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.