Chart of the Week

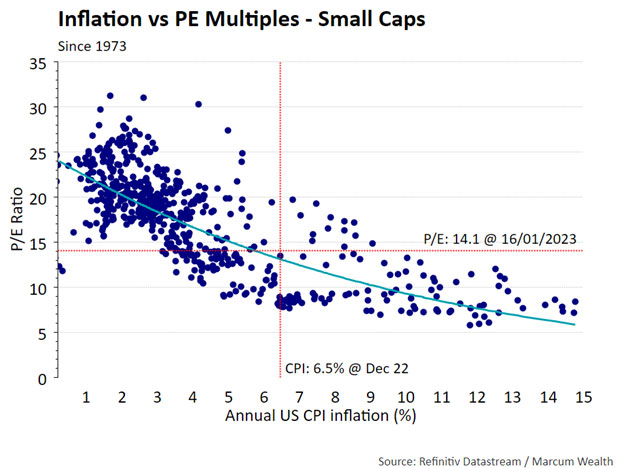

Inflation’s high during this cycle was in June 2022 at 9%. The subsequent six-month annualized change in inflation was 1.9%. That is quite a drop! The increase in inflation caused valuations to fall across equity markets. The trailing P/E ratio for U.S. small caps is now at 14, near the fair value level with inflation at 6.5% over the last year. If inflation continues to come down, the price-to-earnings (P/E) ratio in small caps could move higher. Small caps look like an interesting area for investors to consider allocating capital. On the chart below, that would be an intersection moving up and to the left.

What We’re Reading

The Art and Science of Spending Money – Morgan Housel

Cyclical Outlook Key Takeaways: Strained Markets, Strong Bonds – PIMCO

Where 27 firms Forecast Home Prices for 2023 – Fortune

Byron Wien is back with his 10 Surprises of 2023 – Blackstone

Podcast of the Week

The Chances of a U.S. Soft Landing – Odd Lots

The Past Week

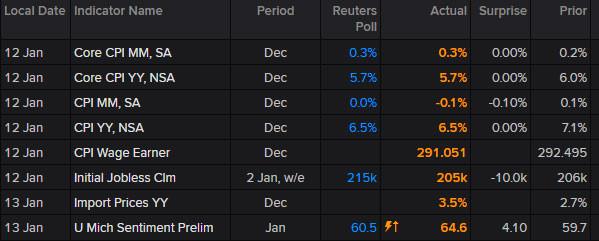

Last week the focus was on inflation, which surprised to the downside with a monthly decline of 0.1%. The price data continues to move in the right direction, and while the Federal Reserve is not ready to declare victory the markets celebrated the news. Another positive datapoint was consumer confidence coming in higher than expected.

The Week Ahead

This week we will see how consumers spending changed this past holiday season. Markets will also get a gauge of the housing market’s slowdown with reports on new starts and existing home sales.

Thank you for reading.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.