Chart of the Week

What a difference a year makes.

The recession that everyone saw coming never happened. The bear market that had already happened left markets sentiment lopsided.

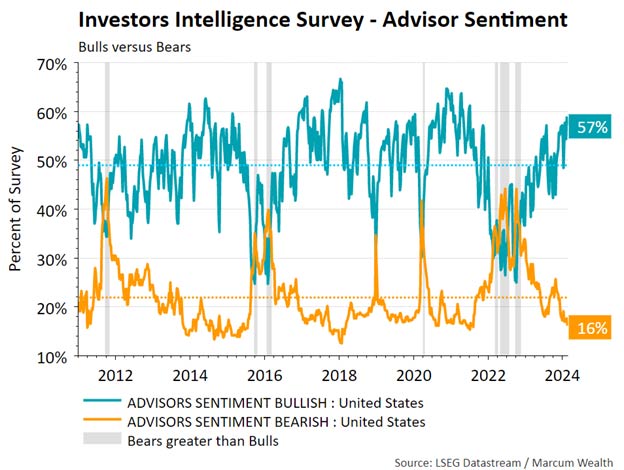

The story is different today. As of the latest survey, 57% of advisors felt bullish on the market, compared to 25% in the fall of 2022. Just 16% of advisors are bearish today versus 44% at its peak.

Overly bullish markets do not mean there is an action to take. It is good to be aware of how investors feel about markets today as it could lead to opportunities in the future.

What We’re Reading

The Key to Personal Financial Planning: Being Lazy – Morningstar

Views From the Floor – Japan Stock Market Record – Why it’s Not Bubble 2.0 – Man Institute

A Primer on Private Credit – Marquette Associates

Getting the Best Employee Ideas – Harvard Business Review

Podcast of the Week

Fortress Sees $1 Trillion Real-Estate Debt Opportunity – Credit Edge, Bloomberg

Last Week

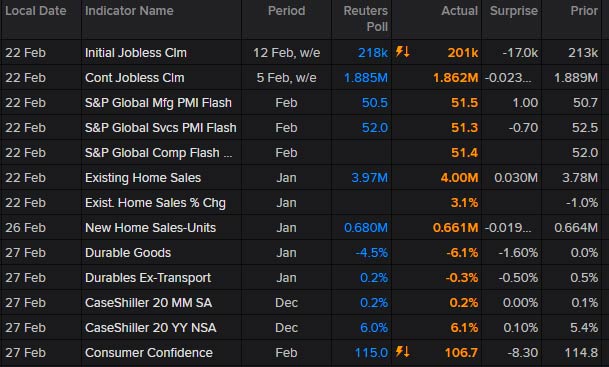

Economic data keeps surprising on the upside in aggregate, though home sales and consumer confidence were lower than expected. For companies in the S&P 500, earnings season was strong. With 90% of companies reported, earnings grew 8% from a year ago versus the expectation of only 1% growth. It is no wonder that equities keep moving higher.

The Week Ahead

We will get an important price data point on Thursday with the PCE (personal consumption expenditures) price index. The jobs report for February will be on the second Friday of March, instead of the usual first Friday. This is due to the dates the Bureau of Labor Statistics collects the survey data in the prior month.

Thank you for reading.

Important Disclosure Information

Marcum Wealth, LLC (“Marcum”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply a specific level of skill or training. A copy of Marcum’s current written Disclosure Brochure discussing its advisory services, fees, and material conflicts of interest is available upon request.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum), or any non-investment related content, made reference to directly or indirectly in this communication, will be profitable, equal any corresponding historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Certain strategies and vehicles referenced in this communication, such as private investments, Opportunity Zones, and ESG investing, may present increased or novel risks, including potentially higher management fees, reduced liquidity, shorter performance histories, or increased legal or regulatory exposure, compared to more traditional publicly traded securities and investment strategies. All investors should consider these potential risks in light of their individual circumstances, objectives, and risk tolerance. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. The asset allocations reflected in this communication are targets only. Actual allocations can and often will deviate from these targets, including in instances of volatile markets, large deposits or withdrawals, or during account rebalancing.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and (3) a description of each comparative benchmark/index is available upon request.

Not all services described herein will be necessary or appropriate for all clients. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. The potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances, and overall objectives. Neither personalized services nor financial or professional resources or processes should be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.

If you are a Marcum client, please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify/advise us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. Tax and accounting services provided by Marcum, LLP. Insurance services provided by Marcum Insurance Services, LLC.