Chart of the Week

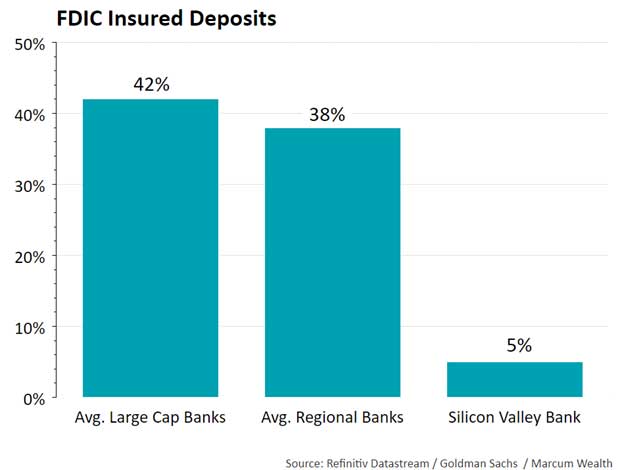

A classic run on the bank occurred late last week causing Silicon Valley Bank (SVB) to go into receivership by regulators. Losses on SVB’s bonds caused investors to question the health of its balance sheet. The chart below shows how little deposits the bank held were insured, making it more susceptible to withdrawals. Because SVB was mainly a business bank, most of its deposits were over the $250,000 limit. The Federal Reserve and Treasury guaranteed all deposits of the bank to prevent further contagion in the system. Any losses to the FDIC to support uninsured depositors will be recovered by special assessments on the rest of the banking sector. Equity and unsecured debt investments in the bank are not protected and senior management was fired. A similar situation occurred with Signature Bank in New York on Sunday as it also failed.

What We’re Reading

Silicon Valley Bank Failure – JPMorgan

Regulators Act to Shore Up Banks – Reuters

The Surprising Effects of Remote Work on Demographics – The Atlantic

Too Many Employees Cash Out Their 401(k)s When Leaving a Job – Harvard Business Review

Podcast of the Week

How the Federal Reserve Grew More Powerful Than Anyone Ever Imagined –Odd Lots, Bloomberg

The Past Week

Overshadowed by the banking world, the jobs report delivered a strong gain of 311,000 new jobs. The unemployment rate moved higher from 3.4% to 3.6%. On Tuesday, inflation came in at expectations though core inflation was hot.

The Week Ahead

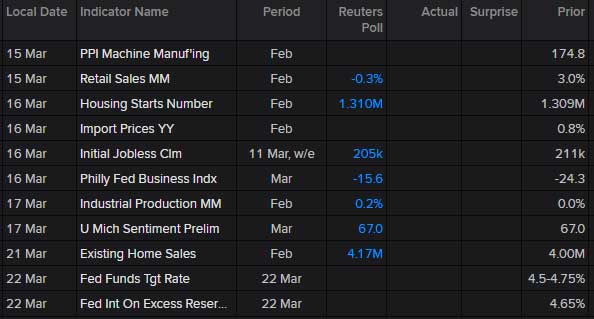

The big question investors have is what the Federal Reserve will do at its meeting on March 22nd. Just a week ago, markets anticipated an increase of 0.50%. Now the question is will it keep with a quarter point increase to maintain its fight against inflation? Or will it error on the side of stability and pause hikes to allow the financial sector to digest the major changes over the past week?

We will continue to monitor events in markets and provide updates.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.