Chart of the Week

It is always a long weekend when you are waiting on Sunday night for a possible press release from the central banks and regulators. I recall the same anticipation after market volatility in 2008 and 2020 as leaders looked to stabilize the global financial system. This time, the U.S. Federal Reserve and global central banks (Canada, England, Japan, and Europe) announced a coordinated effort to support the banking system and keep dollars flowing.

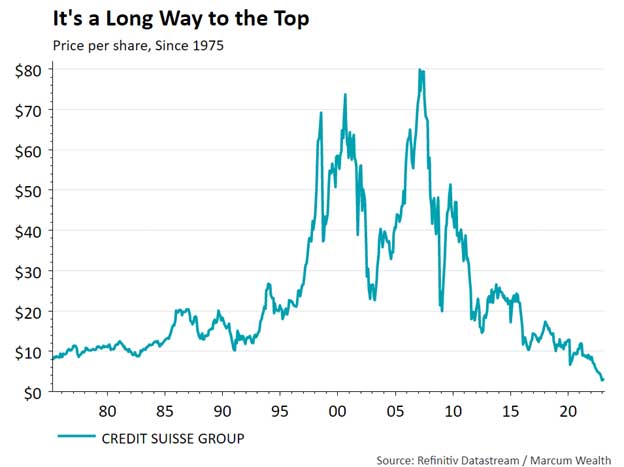

In addition, an agreement for UBS to acquire Credit Suisse was made with the support of the Swiss National Bank. The move came after Credit Suisse entered 2023 with its stock already at a 48-year low, selling well below its 2007 peak reflecting its continued challenges to right the ship following the Great Financial Crisis in 2008.

What We’re Reading

Psychological Paths of Least Resistance – Morgan Housel

Current State of the Housing Market – Calculated Risk

Why a Long-Term Bond Bull Is Still Bullish – Morningstar

Podcast of the Week

The Regulatory Blunder That Gave Us the Silicon Valley Bank Disaster – Bloomberg, Odd Lots

The Past Week

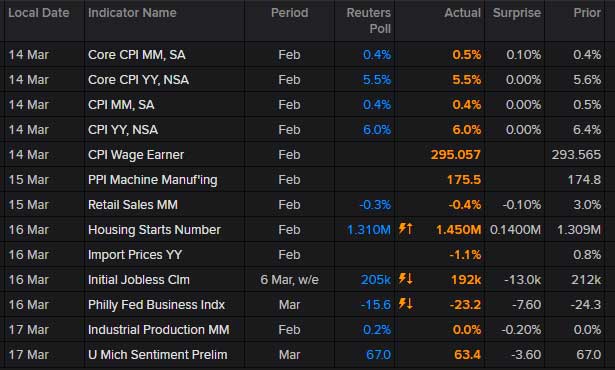

Inflation was in line with forecasts, though it had less attention than the last several months. Housing starts improved while retail sales fell short. Despite calls for an economic slowdown, jobless claims remain below 200,000. The Philly Fed Index and Industrial Production both disappointed, providing some support for the economists with negative forecasts.

The Week Ahead

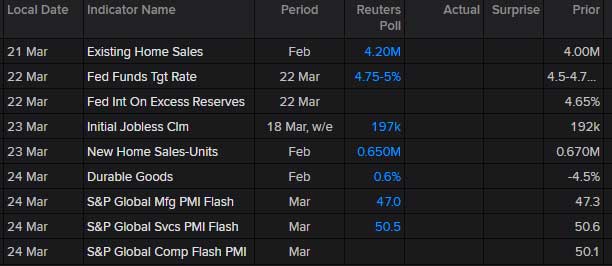

Financial stability is the third, but arguably most important, mandate of the Federal Reserve. Given the volatility in banking and support required over the weekend, many question whether inflation should be the main concern. If inflation remains at the forefront, then expectations are for another increase of 0.25% in the Fed Funds rate. There remains a chance we see a pause or a discussion of a pause in the pace of rate increases.

Thank you for reading.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.