Chart of the Week

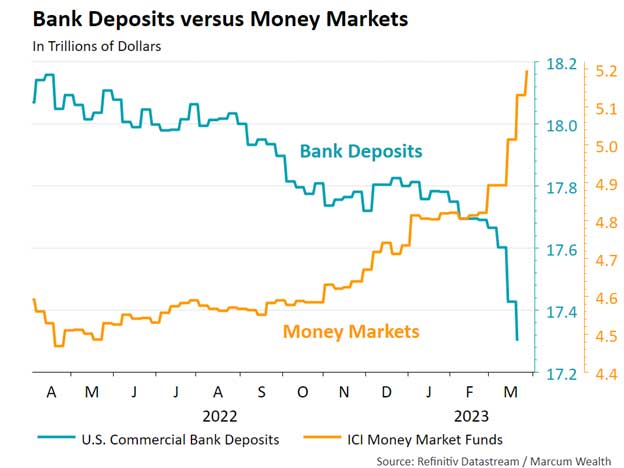

Hundreds of billions of dollars moved out of banks last month. Given the turmoil and better yields elsewhere, this was not a surprise. Money markets were a large beneficiary. Cash flows went into government money markets along with movement into Treasuries and Certificates of Deposits. While this is great for short-term holdings, long-term money should consider locking in yields for a longer duration. That would be moving out into the intermediate-duration range. The Fed is holding short-term rates in restrictive territory, far above what it deems as neutral. These times have not lasted long in recent years.

What We’re Reading

Myth-Busting: The Economy Drives the Stock Market – CFA Institute

Guide to the Markets – JPMorgan

How Plan Sponsors Can Offer Backdoor Roth Conversions – Plan Sponsor

Is it finally time for Europe Equities? Viva La Revolución! – Verdad

How a Midwestern Insurance Salesman Cornered the Classic Car Market – Bloomberg

Podcast of the Week

Ken Kencel on the Rise of Private Capital – Masters in Business

Last Week

Manufacturing and services data came in below expectations. In addition, the ADP jobs report showed fewer jobs than forecast for the month. On the positive side, prices for personal consumption were lower as confidence grows that inflation peaked last summer.

.

The Week Ahead

Over the coming days we have high impact data releases. On Friday, the March jobs report comes out, and then on Tuesday the latest Consumer Price Index. Retail sales will be interesting as the banks reported mixed results on credit card spending during the market volatility seen last month.

Thank you for reading.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.