Chart of the Week

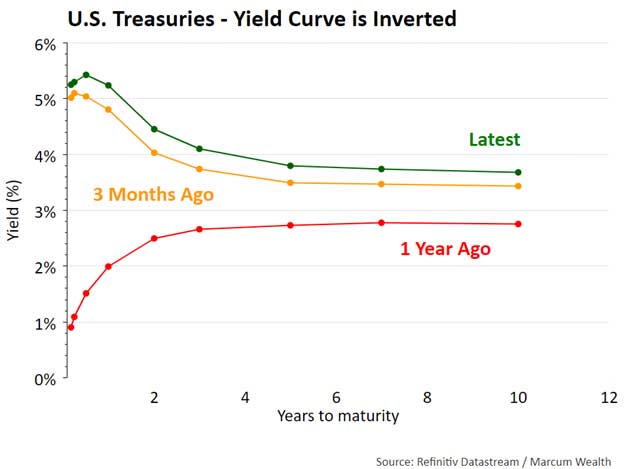

An agreement is in place to raise the debt ceiling until January 1st, 2025. It goes to the House for a vote on Wednesday and, if passed, to the Senate later in the week. The deal is a reduction of $1.5 trillion in discretionary spending over the next decade. This reduces spending to 0.1% to 0.2% of GDP over the next two fiscal years. The deal lowered the volatility of short-term U.S. Treasury bills as worries of a default dampened. Still, the strength of the economy and prices has put Federal Reserve interest rate hikes back in play after a pause was expected a few weeks ago. May’s jobs and CPI reports will be key datapoints to watch as traders decide how many more hikes are possible. The yield curve remains inverted at a higher level than just three months ago.

What We’re Reading

Expectations Debt – Morgan Housel

Investors Want More Exposure to Japan – Institutional Investor

Get Ready for Every Asset Manager to Launch an AI-Based ETF – Investment News

Venture Capital Coming Back Down to Earth is a Good Thing – Adams Street

Podcast of the Week

Imagination, Volatility, and the Pursuit of Alpha – Invest Like the Best

Last Week

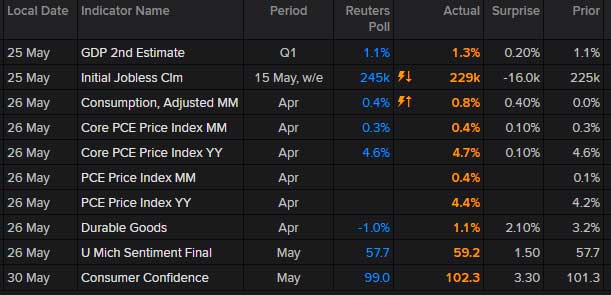

Gross Domestic Product (GDP) was revised higher to 1.3%. The Core Personal Consumption Expenditures (PCE) Index came in above expectations, showing price inflation remains sticky to the upside. Durable goods orders, sentiment, and consumer confidence outpaced estimates.

The Week Ahead

On Friday, we will see the jobs report for May and if the economy can continue adding jobs in the face of recession calls. We also see a batch of economic activity reports on manufacturing and services.

Thank you for reading.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.