Chart of the Week

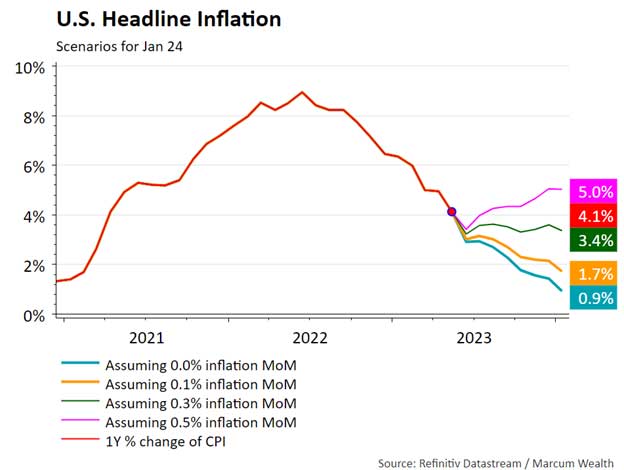

In May, headline inflation data fell from last year’s 9% to 4.1%. Prices fell at a faster rate than they rose in the 12 months leading to the June 2022 peak. This follows a similar pattern from the last five times that inflation peaked at over 6% in the US. Each time the peak rate of inflation ended near where it began two years prior.

The pattern indicates the Consumer Price Index is continuing to fall. The lower pace of inflation gives the Fed some much-needed breathing space for its meeting this week. However, core inflation remains stubbornly high. The July Fed meeting is still “live” as the committee members debate another hike. The good news is that the healing supply chain and rate hikes are having the intended impact of lowering inflation.

What We’re Reading

Paying Attention (to what matters) – Morgan Housel

Words of Wisdom from the late Sam Zell – Novel Investor

House unanimously passes bills to expand accredited investor pool – Investment News

Bill to Fix Big Secure 2.0 Drafting Errors Is Coming – Think Advisor

How Plan Sponsors Can Shift Focus to Decumulation – Plan Sponsor

Podcast of the Week

Why Fertility Rates Are Plunging—in the U.S., South Korea, and Everywhere Else – Plain English

Last Week

Inventories fell less than expected, while jobless claims ticked higher. The strong jobs report for May seems to conflict with the weekly data. Anecdotally, the jobs market remains tight based on our conversations, and the surveys continue to confirm the trend.

The Week Ahead

The Fed Chairman’s press conference on Wednesday will be watched for any hints about the future likelihood of an extended pause or just a skip of hiking at this week’s meeting. Retail sales, industrial production, and consumer sentiment are on the radar for key data releases.

Thank you for reading.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.