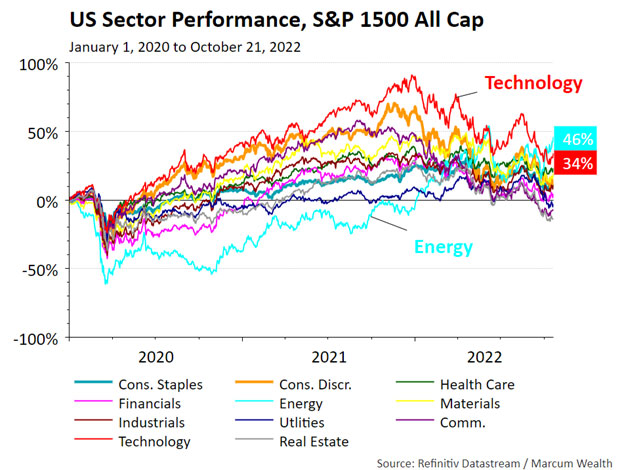

Chart of the Week

After falling 61% in 2020, the energy sector staged a comeback for the ages. Readers may recall oil prices fell negative for a trading day in April 2020. The sector now is the top performer since the start of 2020. It just surpassed the technology sector, which was the winner during the work-from-home stage of this recovery.

What We’re Reading

Consumer Checkpoint: Real Time Data on Spending Trends – Bank of America

Little Rules About Big Things – Morgan Housel

The COVID-19 Baby Bump – National Bureau of Economic Research

US Chip Sanctions ‘Kneecap’ China’s Tech Industry – Wired

Quarterly Economic and Interest Rates Commentary – Hoisington

Podcast of the Week

This Is What the US Just Did to China on Semiconductors – Odd Lots, Bloomberg

The Past Week

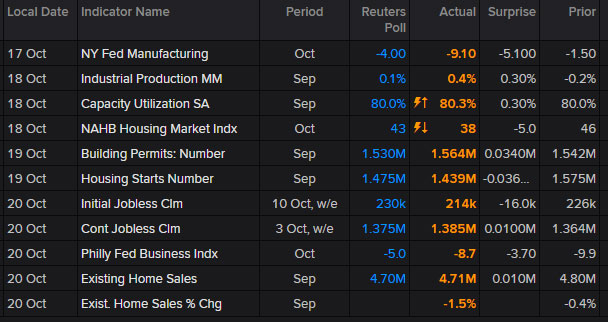

Last week higher industrial production and lower jobless claims were both better than expected. On the downside, reports from the New York and Philadelphia Fed offices showed declining economic activity. The homebuilder survey surprised on the downside and was confirmed with less existing home sales in September.

The Week Ahead

Monday started with a disappointing report on services and manufacturing data from S&P. This week we will see how durable goods orders are holding up along with GDP for the third quarter, with economists expecting growth of 2.4%. We will also get the Case-Shiller report on home prices, with estimates for another monthly price decline.

Talk to you next week.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.