What Happens When the Fed Raises Rates?

By Michael McKeown, CFA, CPA - Chief Investment Officer

The Federal Open Market Committee raised interest rates for the first time this cycle. This signals a further change in the stance from the accommodative policy in place since March 2020.

The goal is to slow inflation by increasing the cost of debt. In turn, this lowers demand. The balancing act is trying to do this while maintaining economic growth.

The cost of debt will increase for businesses and consumers using floating rate loans and future fixed rate loans. On the plus side, we will see rising interest rates for savings accounts, CDs, and short-term bonds.

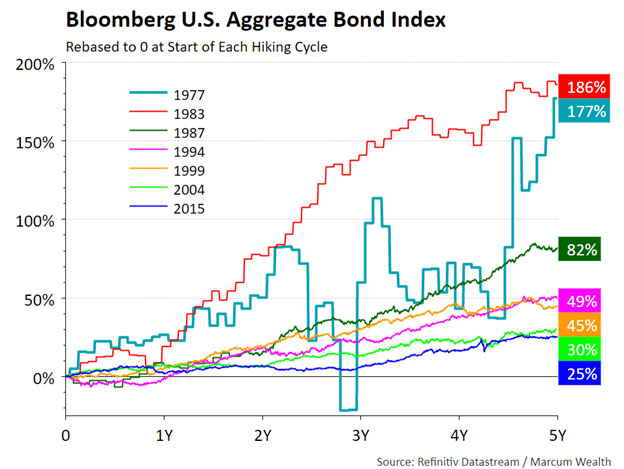

When interest rates rise, bond prices fall. The repricing of bonds in this cycle has been harsher than in the past give the speed and magnitude of expected hikes. Just a year ago, markets were pricing several more years of accommodative policy.

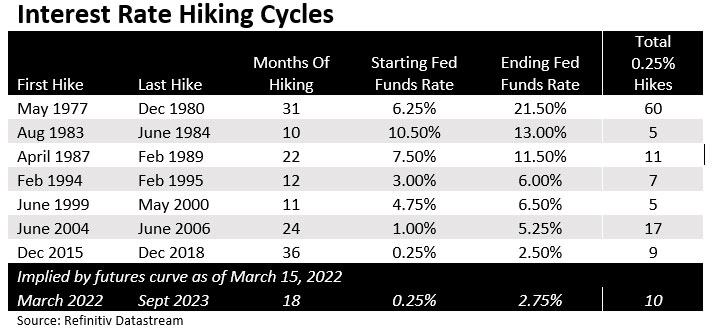

The following table shows the duration and magnitude of each time in the last 45 years the Federal Reserve raised rates more than five times. This time, the market odds implies ten interest rate hikes, with seven hikes by the end of 2022.

Some would think it is a terrible time to own bonds during these periods. Historically, this was wrong. Bond prices produced positive returns on a five-year view from the first rate hike using the most widely followed bond index.

In fact, only 1994 saw returns that were not positive one year after the first hike. The index total return was -1% after the first hike in February 1994. This initial rate hike was a total surprise hike by then Fed Chairman Greenspan. Since then, Federal Reserve members communicate to markets and the public their outlook for interest rates all of the time to avoid surprise. In fact, the communication is considered part of the policy as they understand all of the Fed speeches and press conferences have an impact on interest rates.

The high inflation of the late 1970s did see a rough ride for bond returns, though the results annualized at over double digits once inflation was tamed.

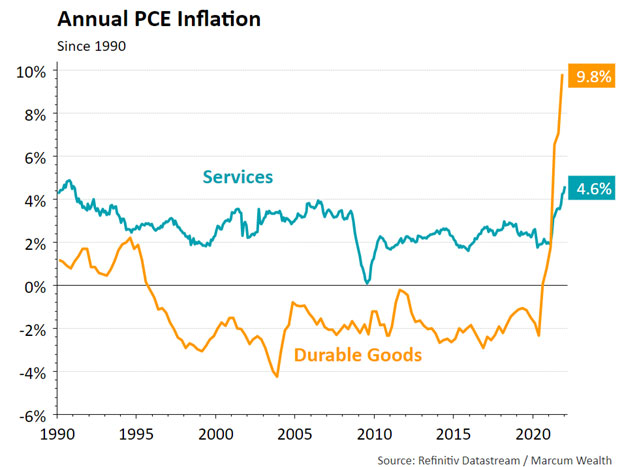

This gets to the bear case today. Supply side issues are causing inflation to be above the Fed’s target and affecting consumers negatively.

This in turn is causing durable goods prices to rise far above the levels of the past three decades.

In a pandemic world of lockdowns and massive fiscal stimulus, consumers shifted spending to goods from services. Will this continue to last? The spending shifts along with the extent of further stimulus will be key factors on inflation and rates in the years ahead.

If past is prologue, it pays to be patient with bond portfolios despite the Fed raising interest rates. We will continue to monitor the inflation outlook to see if changes in spending, interest rate hikes, and policy measures begin to change inflation’s trajectory.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.