The initial market reaction to the Fed’s 50 basis point hike in May was a sigh of relief, but it was short-lived — we’re now seeing interest rates hit new highs and equity prices fall.

At the end of the day, the Fed is taking its inflation mandate seriously. Unfortunately, the Fed’s toolkit cannot address supply chain issues at ports or get more oil out of the ground to alleviate inflation pressures. Getting prices under control means slowing demand. Part of that happens through the wealth effect: when people feel wealthy they spend more, and vice versa.

Asset prices, including stocks and real estate, are a major part of the wealth effect. With demand running too hot for goods and services, the Fed is raising interest rates to slow demand. Higher financing costs mean households and businesses will find it more expensive to spend. This approach is in stark contrast to the past few decades when the Fed used the wealth effect to increase demand.

A side effect of the Fed’s current policy is lower asset prices. The previous policy created a virtuous circle of rising asset prices and more spending, to make up for the lower growth trajectory. This worked well when inflation was under control and below the Fed’s target of 2%.

The Fed does not want inflation to spiral higher and out of control now. It has to balance this against the risk of increasing the unemployment rate and a potential recession.

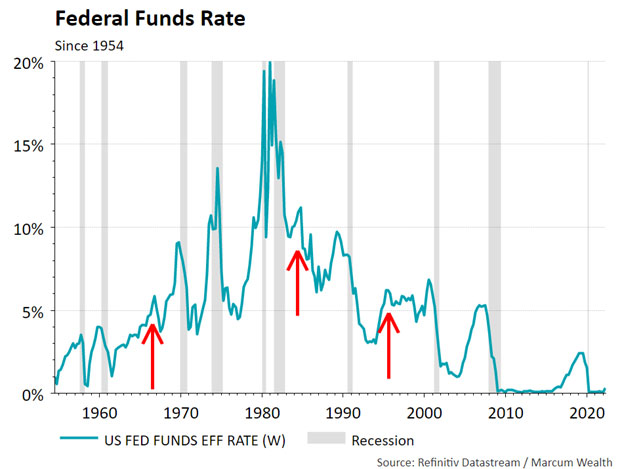

A few times in history, the Fed raised interest rates without inducing a recession. This is the “soft landing” everyone would like to see. These periods when economic expansion went on beyond two years are shown in the red arrows below.

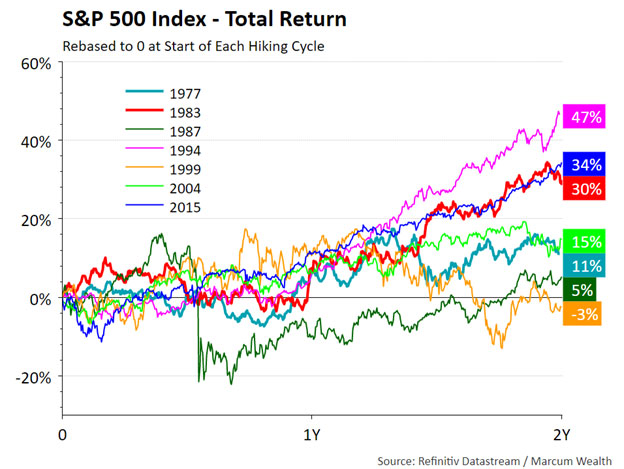

Despite rising rates, asset prices historically went higher during Fed tightening cycles. Equity prices were up in six of the last seven hiking cycles, in the first year and in the second year after the first rate hike. There were volatile periods, of course, which is the rule rather than the exception for equities.

For now, we have a playbook to execute. We will continue to monitor inflation data, commodity prices, and the rising U.S. dollar. At some point, the Fed’s policy will have its intended impact. When this occurs, we believe the Fed will look to bring more support to the economy and thus, asset prices.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.