Why the Market Keeps Going Up

By Michael McKeown, CFA, CPA - Chief Investment Officer

Many people are wondering what is behind the relentless move higher in stock prices.

We see several factors contributing to the positive direction.

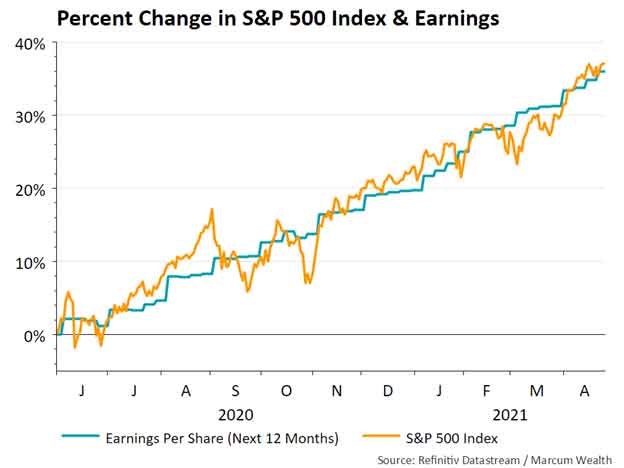

Since last June, earnings expectations for the next 12 months increased by 36%. The S&P 500 returned 37%.

In aggregate, corporations adapted well to the pandemic. While many sectors were hurt, others thrived.

Government fiscal stimulus helped consumers and businesses tremendously.

The Federal Reserve programs in March 2020 supported the corporate bond market and lowered borrowing costs.

The vaccine news in November and faster than expected roll out increased expectations.

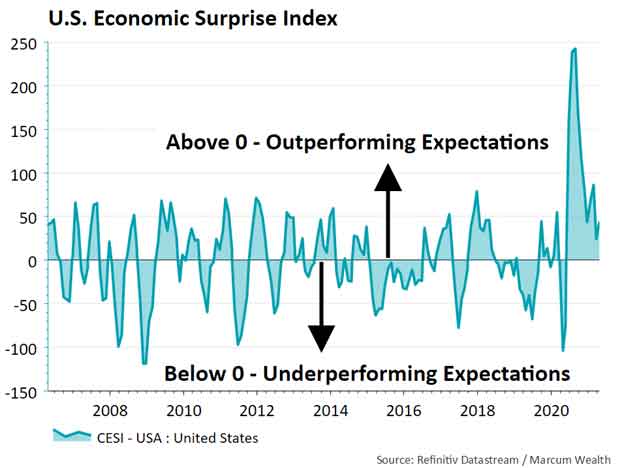

Economic data continues to outperform economists’ expectations. The period since June 2020 has seen the longest streak of outperformance in the last 15 years. This trend moves above or below the zero line as expectations change.

The market outperforming expectations is a clear positive. But it cuts both ways. If earnings or economic data disappoints, we may see a pause or pullback in equity prices.

This would be normal. In any given year, the average peak to trough decline in equity prices is 13%.

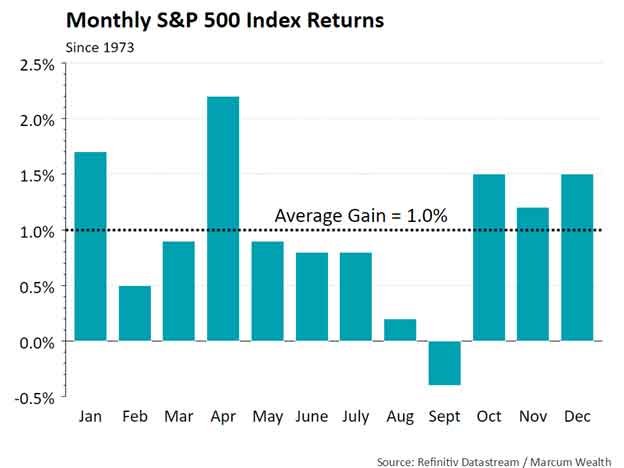

Historically, the market’s five strongest months are during the October through April period. The summer and early fall tend to see weaker performance than average.

Still, the momentum of the market is positive today. Across asset classes and regions, prices tend to trend in the direction they are currently going.

Prices hit a new all-time this month. Since 1950, markets hit new all-time highs 22 times during April. Prices were higher for the rest of the year in 20 of those instances, by an average of 8%.

Potential increases in corporate and individual tax rates have been floated by the current administration. Most strategists see the proposed new rates as a starting point of negotiation, with tax rates likely to move up only marginally.

Surprisingly, tax changes historically do not have a big impact on markets. Deferring gains further into the future is an option for some investors. There are also several tax efficient strategies for equity exposure to minimize or eliminate capital gains.

Equities are long duration assets. Investors should have a long-term time horizon for equities, allowing the compounding of capital to work its magic. The whims of market participants and real world events can bring price volatility at any time. These risks can be opportunities for thoughtful investors with a game plan.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.