Economy Slowing, but Growing

By Michael McKeown, CFA, CPA - Chief Investment Officer

A few concerns about the economy have popped up recently. Supply chain issues, geopolitics, the delta variant, and tapering asset purchases by the Federal Reserve are the major headline risks today.

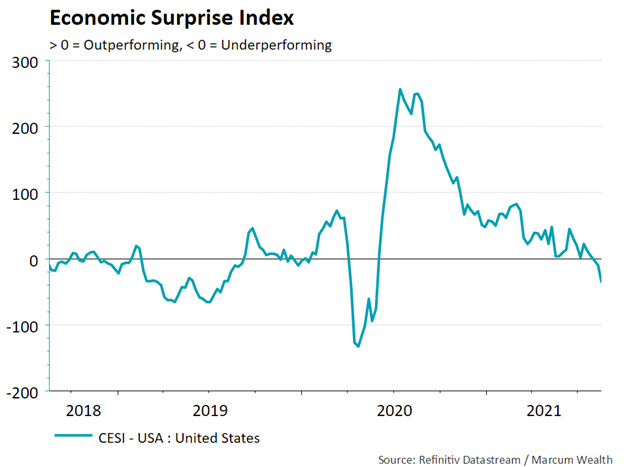

The strong economic data finally caught up to expectations. The chart below takes economic data across labor, corporation, and households to see if these categories are above or below what economists estimate. When above zero, it is outperforming. This is where it has been from June 2020 until July 2021. Lately, data were below expectations in aggregate.

The Economic Surprise Index ebbs and flows over time as forecasters attempt to calibrate where the economy will be going.

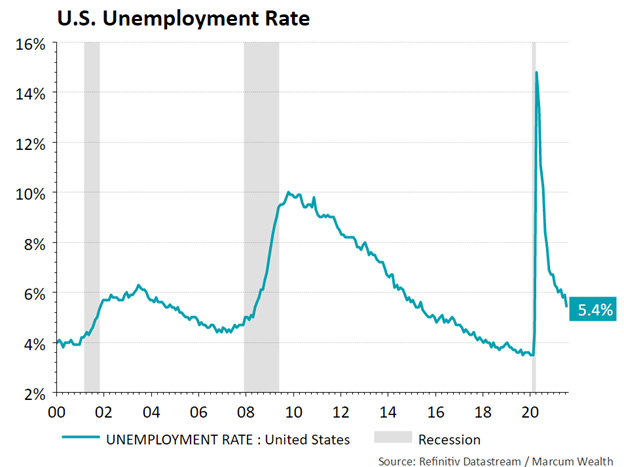

In the big picture, following employment trends is a good indicator. If businesses are confident about the outlook in the economy, hiring will continue.

Last September, the Federal Reserve said that unemployment could have fallen even further in the last cycle. This means the Fed will likely remain accommodative longer with its interest rate policy. The unemployment rate is at 5.4% currently. There is certainly room for it to fall further at as we reached 3.5% less than two years ago.

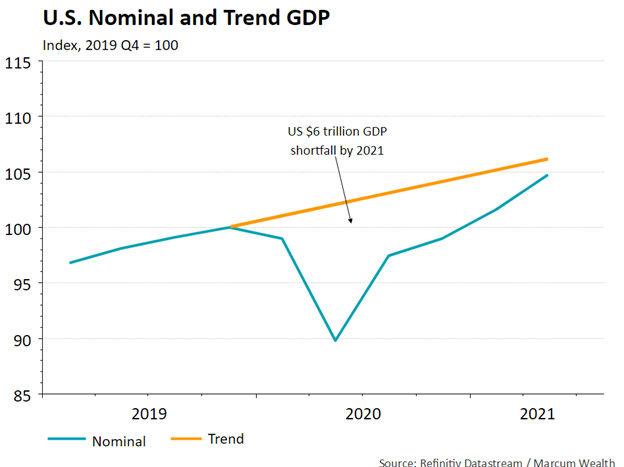

The economy remains on track to get back to the trend Gross Domestic Product (GDP) it was on prior to the pandemic and recession. It is already above the levels of the fourth quarter of 2019.

Markets and the economy usually do not grow in a straight line. It almost looks that way since the recession ended in April 2020. There really have been ebbs and flows in markets and the news flow since that time. With a seasonally weak period for markets ahead, preparing for potential volatility while thinking about the big picture remains important.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.