Housing: A Little Bit Softer Now

By Michael McKeown, CFA, CPA - Chief Investment Officer

As the peak home buying passes this summer, home price bidding wars are slowing a bit.

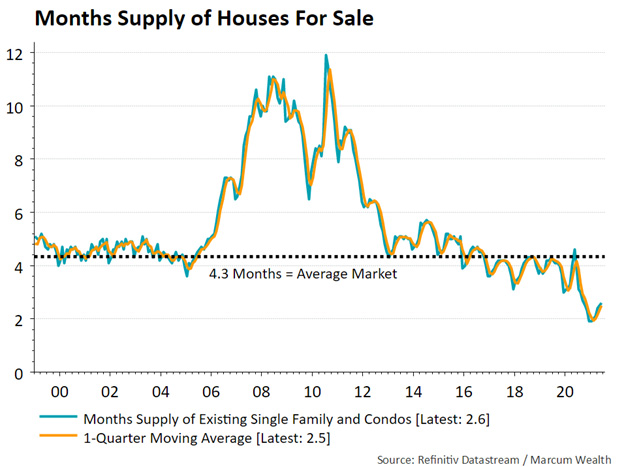

The market is coming off a record low supply of homes for sale in the U.S. at below 2 months. The latest data from June has 2.6 months available for sale. This is far below average. It is extremely low compared to the 10 months of home supply following the housing bubble from 2008 to 2011.

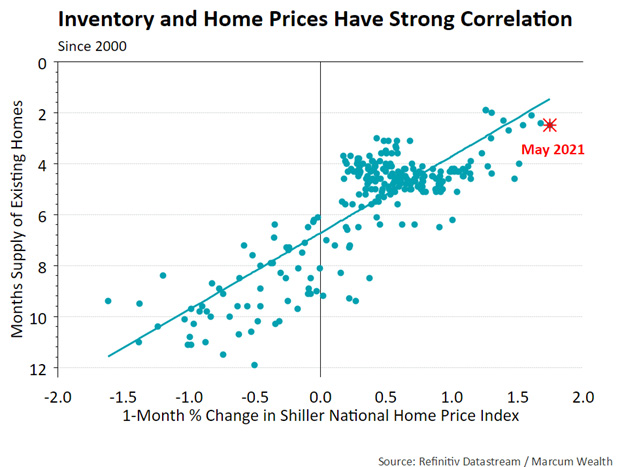

The inventory matters because it has a tight relationship with home appreciation. This past year has seen the fastest monthly increase in home prices with the latest increase at 1.7% from April to May. In the past 21 years, prices only declined when inventory was greater than six months.

Home builders are weary of overwhelming supply. No firm that survived the last housing bubble wants to go through it again. Supply chain issues for materials are also slowing sales.

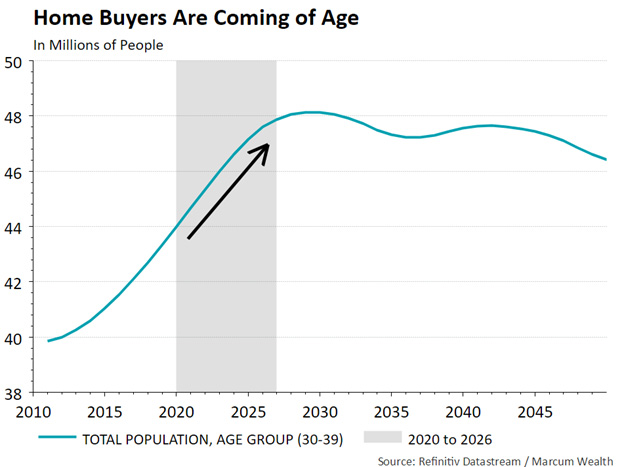

The demand side for homes is only going to increase. The median age of millennials is 31 years old. The median home buyer is 33 years old.

It took 10 years, from 2010 to 2020, for the population of people in their 30s to increase by 4 million. From 2020 to 2026, another 4 million will be coming of age to their 30s. This represents even more buyers entering the pool.

We follow housing closely for a few reasons.

One of the largest assets many families own is their home. Life changes usually drive the buying and selling of homes rather than a pure economic motive. This usually only occurs a few times during a lifetime. Questions often arise around the financial planning for such big events.

Within fixed income portfolios, we own mortgages. Bonds backed by mortgages are a way to earn a little more interest with a quality asset as collateral.

Zillow’s latest forecast expects home prices to increase 13% over the next year.

People are asking if this is housing bubble 2.0 since prices are climbing at a rapid rate. This is partly due to low inventory. The lowest interest rates in history allow for mortgage payments to support a higher home price as well. Until these factors change, a decline in home prices becomes less likely.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.