Get Ready for the Travel Boom

By Michael McKeown, CFA, CPA - Chief Investment Officer

Can you feel it?

The weather is turning warmer.

Patios are opening up.

People are ready.

After being on lockdown for most of the past year, consumers are ready to get out and start spending. There is so much pent up demand for experiences that have been impossible the past 12 months.

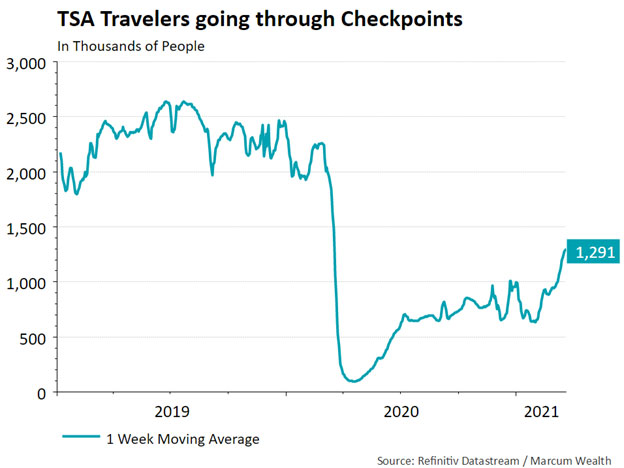

Air travel is beginning to pick up again. It is well off the lows from this time in 2020, though currently it is at half the peak reached in 2019.

According to Bloomberg News: “Searches for ‘Google flights’ reached a peak popularity score of 100 last week, according to a Google Trends tracker. Travel-related searches were already popular before news hit Friday that Americans would begin receiving stimulus payments.”

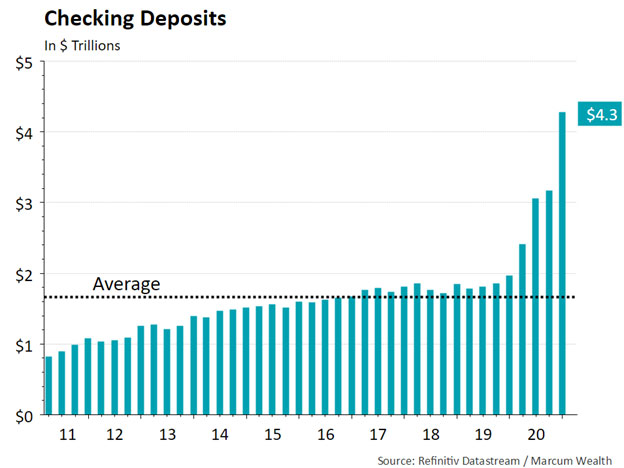

Households have more money in checking accounts than ever.

The travel boom will depend on people’s comfort level and how much local and state governments enact opening measures.

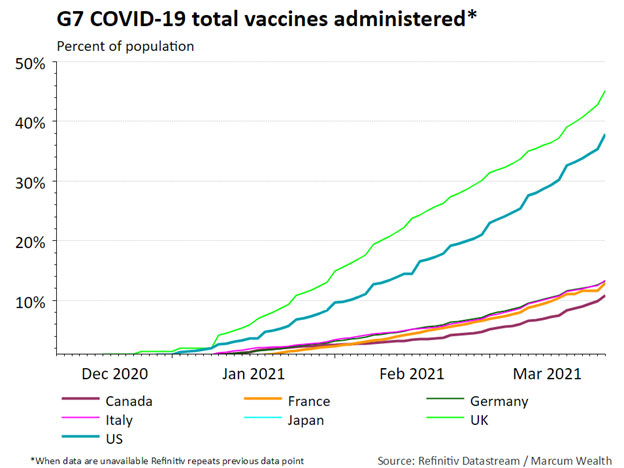

Vaccination rates in the U.S are above where many forecasts projected just four months ago.

Hospitality and airline businesses are getting ready as layoffs in these industries have slowed dramatically. The Challenger Job Cuts data in the leisure sector have fallen back to pre-pandemic levels. There remain about 1 million people in this sector out of work. Hopefully we will see the spending boom to get this sector of the economy back on track.

The prices of flights and hotels are rising going into the summer. If you are looking to book a trip, it likely makes sense to do it sooner rather than later.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.