Interest Rates: Lower for Longer

Last week the Federal Reserve Open Market Committee met and confirmed what most already knew: interest rates are not going anywhere.

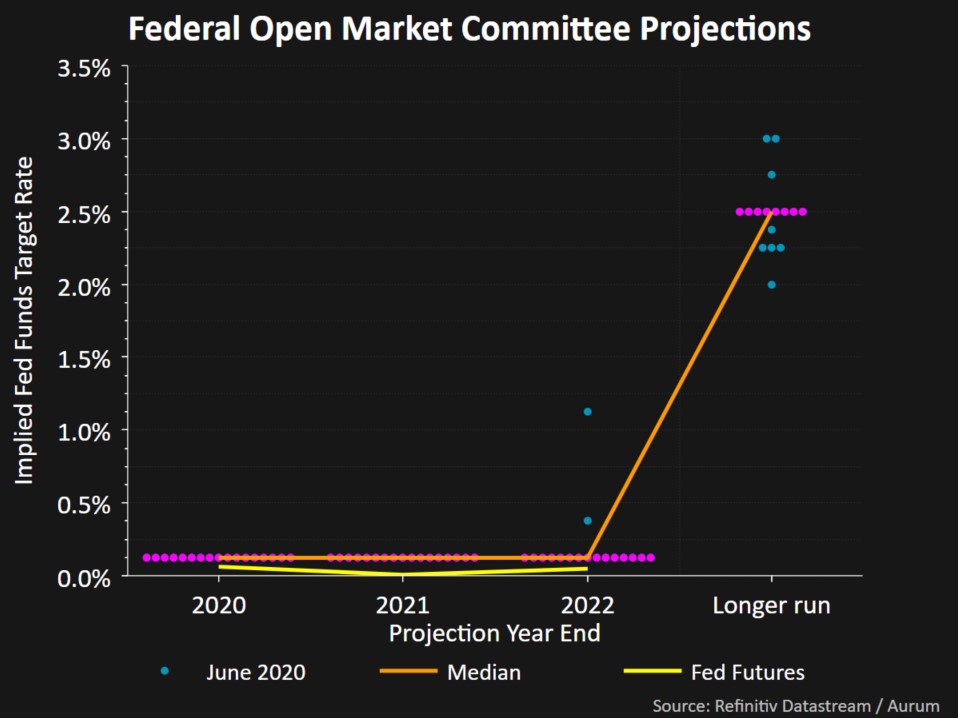

The chart below shows the forecast for where the Fed funds rate will be at year-end for 2020, 2021, 2022, and *hopefully* in the long-run. The Fed sees the rates targeting staying at the 0% to 0.25% range, or effectively, the zero-lower bound.

Even the next two and a half years may not be the end of 0% interest rates. It took seven years following the Great Financial Crisis in 2008 for the Fed to raise interest rates just one quarter of one percent in 2015.

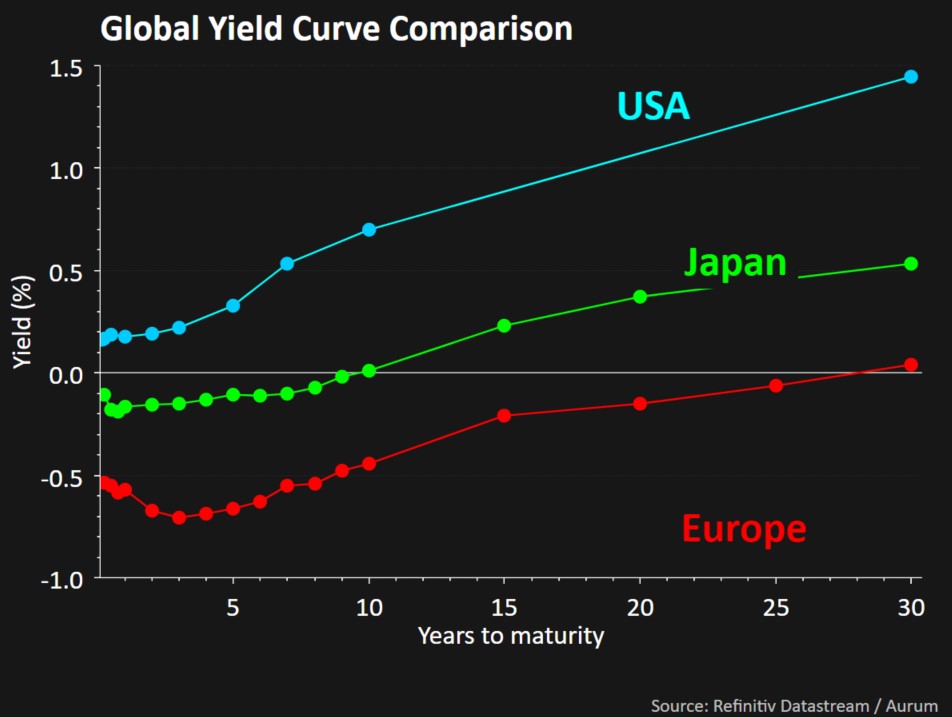

This is also consistent with policies in other developed markets around the world. In Europe and Japan, yields are negative for government bonds with maturities of less than ten years.

It may be tougher for bonds to serve as a ballast to a stock portfolio. Much of the gains in bond prices occur during volatile periods for stocks. Yet yields across most of the U.S. yield curve are below half of one percent and do not have much further to fall. That is, unless yields go negative in the U.S., following the rest of the world.

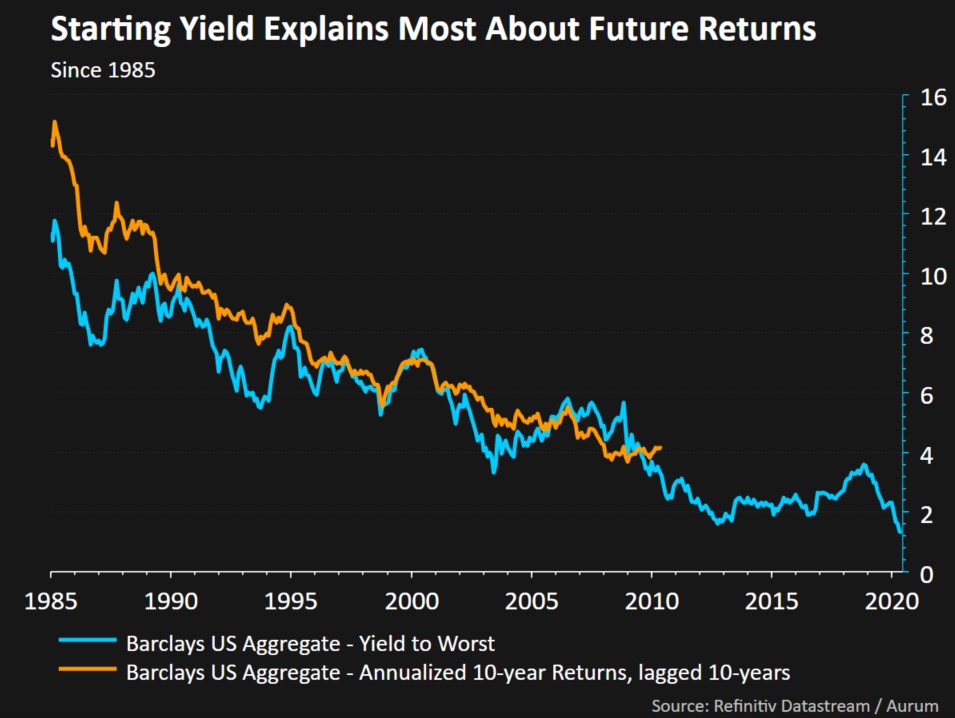

This has implications for bond portfolios going forward. The simple math of bond portfolios tells us that the starting yield is the best estimate of future expected returns. The most widely followed bond index is the Bloomberg Barclays Aggregate Bond Index. Its yield today is 1.3%, which is unlikely to help many people achieve their long-term financial planning objectives.

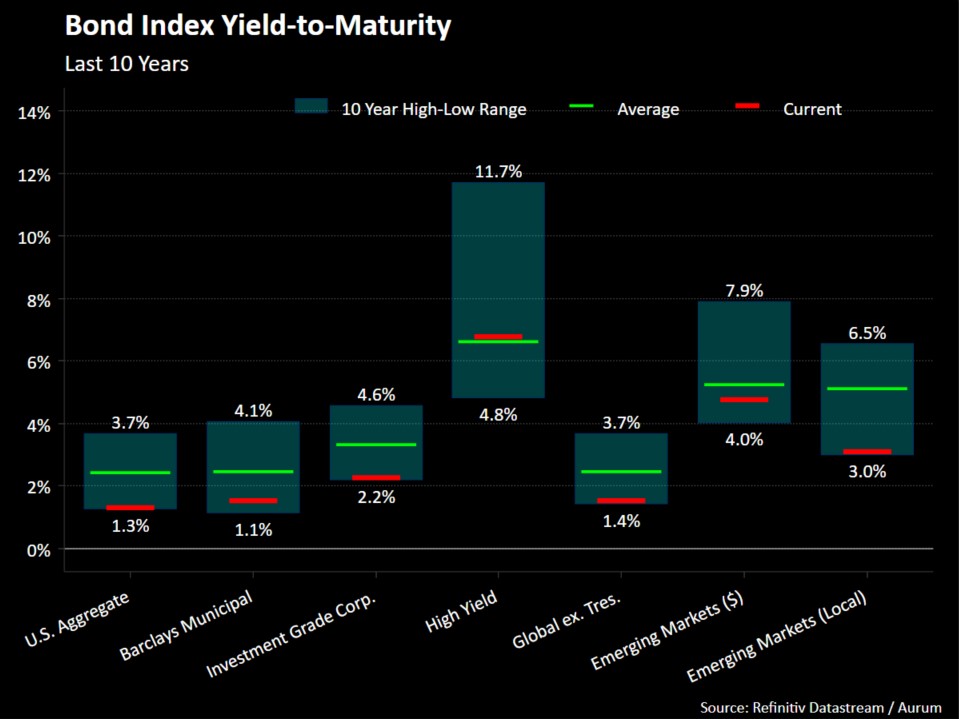

Investors will need to look elsewhere for returns. This may include higher allocations to equity. In addition, taking on credit spread risk within bond portfolios may enhance returns. Of course, this should only be included when offering a fair value for that risk. Today within bonds, only high yield and emerging market dollar-denominated bonds offer a yield to maturity near their average over the last ten years.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.