Navigating Inflation & Recession Risks in 2023

By Michael McKeown, CFA, CPA - Chief Investment Officer

It’s well-established that economists will predict several recessions that don’t happen for each one that actually does. That begs the question, how much attention should we pay to what their recession predictions? When they’re right, they’ll be showered with praise (by the sheer number of predictions, a few turn out to be correct). We tend to simply forget about those that are wrong.

We should also keep in mind that the economy and markets are not the same. Sometimes they move together, and sometimes not. Fortunately, forecasting, which is often a lot of noise without much signal, is not an essential part of a successful investment program. But consistency is.

Accounting for Macro Trends

While we aren’t economists, we do have opinions and can see interesting trends and historical parallels in the biggest financial themes being discussed today.

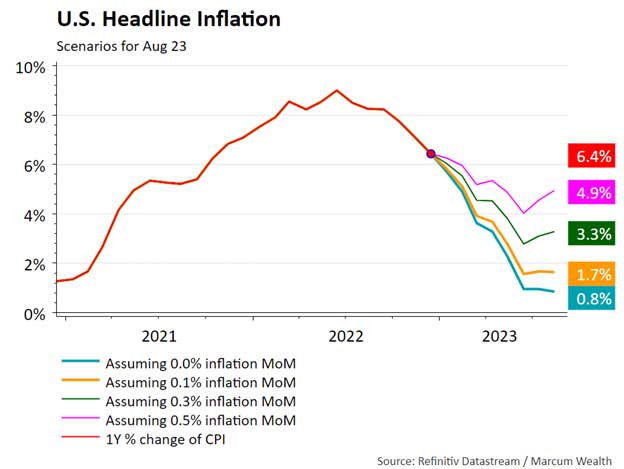

Over the last six months, the average monthly change in inflation was 0.16%. If this trend continues, by the summer we should see the yearly inflation fall to a range of 2% to 4%.

Inflation was high the last few years for several reasons. The fiscal stimulus during and following the pandemic was several magnitudes larger than the dollars given out following the 2008 recession. It seems policy makers did not want to repeat the slow growth that we experienced in the direct aftermath of 2008, as they errored too small with stimulus. It was too big this time, as the St. Louis Fed published that the recent U.S. fiscal stimulus led to excess inflation of 2.6%.1

The pandemic also led to supply chain disruptions that were a result of (i) shutdowns and (ii) high demand as more goods were ordered by consumers. According to surveys, supplier delivery delays reached nearly 80% at their peak. Those delays are now at the lowest level seen in the past decade, suggesting that the worst is behind us.

Low interest rates from 2020 to 2021 spurred national housing prices to climb more than 40%. Rents across the country shot higher. With the interest rate increases over the past year, housing costs have begun to come down. Owners’ Equivalent Rent (OER) tracks inflation in the housing sector. OER has a well-known lag effect that many regional Federal Reserve research groups have written about. For example, housing peaked in the summer of 2022 but the prices are still rising in the OER. The market and economists are beginning to look past this lag as we see in real time, from data providers like Zillow, that home prices and rents are falling.

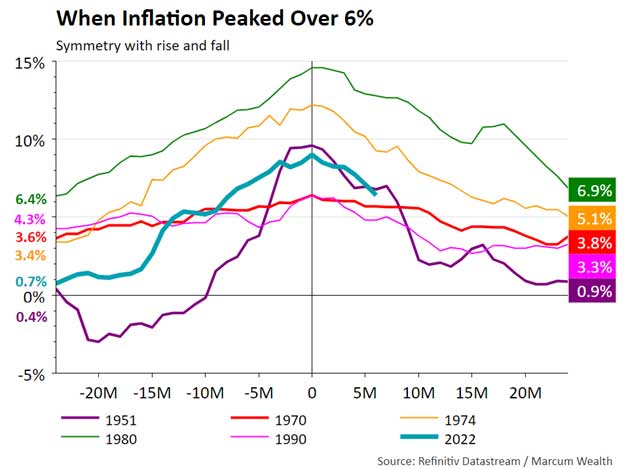

Inflation peaked in June 2022 at 9%. If that was the high, history tell us we are through the worst of it. Inflation has risen above 6% five times previously, in each instance it came down within two years and, like in 1951, sometimes quickly.

It seems inflation is on its way back down. The question remains as to whether the service and wage gains will continue to grow beyond the Federal Reserve’s expectations. It is a balancing act, because the Fed has a dual mandate of price stability and full employment. The last five times inflation peaked over 5%, a recession followed.

Recession Indicators and Your Investment Strategy

Recessions are a sustained economic downturn in activity that results in job losses that challenge the full employment mandate. The National Bureau of Economic Research (NBER) officially calls recessions. It looks at several data points to make its determination. The two most important factors in recent years have been real income less transfer payments and nonfarm payrolls.

While employment growth was positive in 2022, it slowed in the second half of the year with many large companies announcing layoffs to start 2023. Real income grew during the second half of 2022 as inflation fell. On the other hand, hours worked, a metric that tends to lead employment data, fell in each of the two most recent jobs reports.

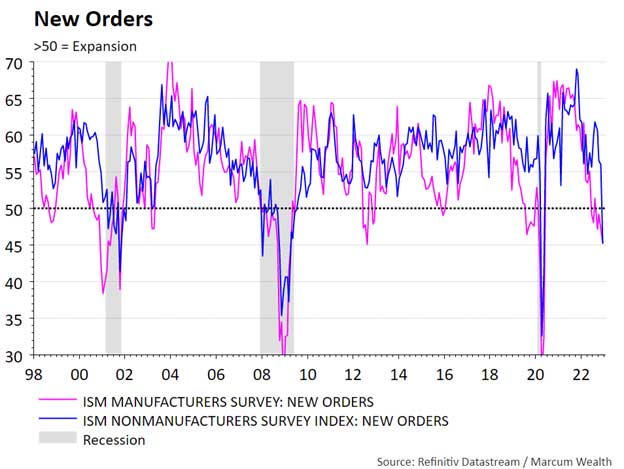

Many survey-based economic data points also fell in recent months. These tend to be leading indicators for the economy. New orders in both services and manufacturing showed a contraction. As seen below, it is rare for both to be below the 50 level and that movement has historically coincided with official recessions calls by the NBER.

The Fed began hiking interest rates in March 2022 and continues on this upward path to start the year. The lag effect of interest rate hike takes a period of time to impact the economy, increasing financing costs for consumers and businesses.

We would like to see a soft landing for the economy for this Fed interest rate hiking cycle. That would mean that inflation falls gently and the economy avoids a recession. This has happened four times in history, in 1966, 1985, 1995, and 2019. The other ten times the Fed embarked on an interest rate hiking cycle since 1954, the economy did enter a recession.

We think the odds of a soft landing are better than what history and the consensus expects. Economists surveyed by Bloomberg in January put the odds of recession at 65% this year.2 We know recessions are cyclical and due to happen within the capitalistic system. But, while certainly devasting for certain workers and businesses, not every recession is a crisis period.

An increased recession risk does not mean investors should abandon financial plans or long-term asset allocation targets. Those remain the personal North Star that each investor should focus on, regardless of the environment.

For us, more volatility means it is time to sharpen our pencils and look to position portfolios for value in a variety of potential scenarios.

Sources

- Demand-Supply Imbalance during the COVID-19 Pandemic: The Role of Fiscal Policy – Federal Reserve Bank of St. Louis

- US Economy Seen Shrinking in Next Two Quarters, Survey Shows – Bloomberg

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.