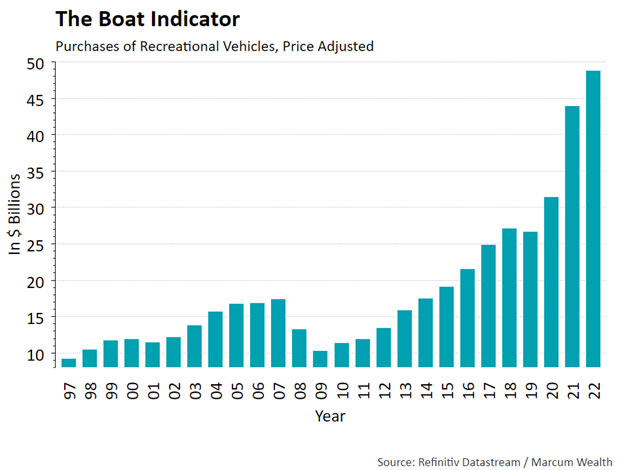

Chart of the Week

Over the last three years, recreational vehicle purchases exploded. In 2022, the pace of these purchases nearly doubled compared to 2019. This makes sense given the lack of travel during the pandemic. With financing costs at double digits though, inventories are on the rise for boats and similar “investments in fun,” as my dad calls them. Larger purchases will be difficult for the consumer to swing. It is one example of the Fed’s efforts to slow demand and put a lid on inflation. The impact of these efforts will be felt across the economy and in a variety of sectors.

What We’re Reading

3 Questions That Will Get Your Finances — and Life — on Track – CNN

The Buck Stops Here – Research Affiliates

Eye On the Market: American Gothic – JPMorgan

The Venture Capital Math Problem – A VC

Podcast of the Week

Landing Soon – The Week Ahead – Macro Horizons

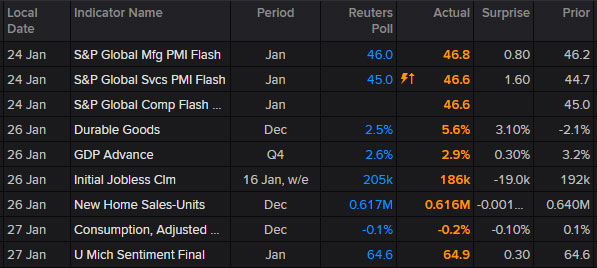

The Past Week

Economic data came in mixed last week. The data outperformed expectations with services and manufacturing but showed a contraction in economic activity. The GDP report was a bright spot with the economy growing 2.9% in an early look at 4th quarter growth.

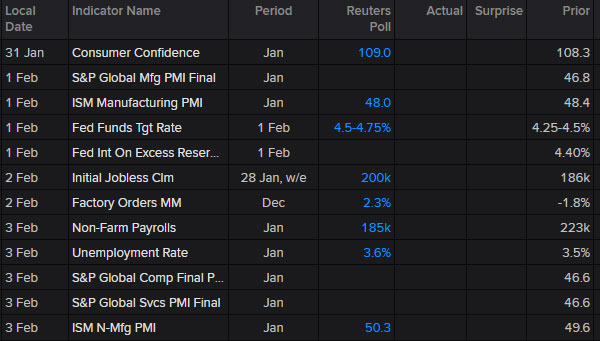

The Week Ahead

The Fed meets on Wednesday and is widely expected to raise interest rates by 0.25%. A meeting at the White House on the debt ceiling will also garner attention. Investors will gauge the growth prospects of the technology sector as mega-cap companies issue their earnings reports. On Friday, the monthly jobs report comes out.

Thank you for reading.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.