Recession Origins & Opportunities

By Michael McKeown, CFA, CPA - Chief Investment Officer

Until the Great Depression, the word “recession” did not exist. Any time the economy contracted the prior 150 years, it was considered a depression. This did not exactly create a positive psychology. It also did not help that each depression until then had lasted several years. Prior to the 1930s, policy makers did not have the tools or understand how to steer the economy out of a downturn.

In an effort to change the narrative, policy makers introduced the word “recession.”

Recessions are simply a part of the cycle in our economic system. There are four stages of the cycle: expansion, peak, contraction, and trough. Then the cycle begins anew.

While a recession is technically two negative quarters of GDP, it needs to be a significant decline in economic activity across markets.

Following the negative growth of GDP in the first quarter of this year, the possibility of recession is on many people’s minds. The latest consumer surveys by the University of Michigan have fallen sharply, driven by high inflation. Housing starts and retail sales are beginning to slow.

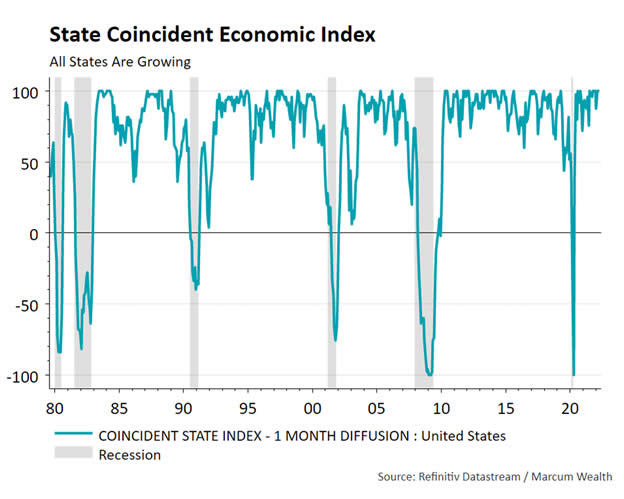

Many other data points suggest a recession is not imminent. The State Coincident Index by the Philadelphia Federal Reserve looks at employment data across each of the 50 states. As an indicator of impending recession, signs of employment contraction are first seen in a handful of states, and then becomes evident in the majority. As the chart below shows, all 50 states as of April show employment growth.

The concern for investors is the temporary decline in stock market prices during recessions. Assuming the investor has no immediate cash flow needs or leverage on the portfolio, then the concern should dissipate.

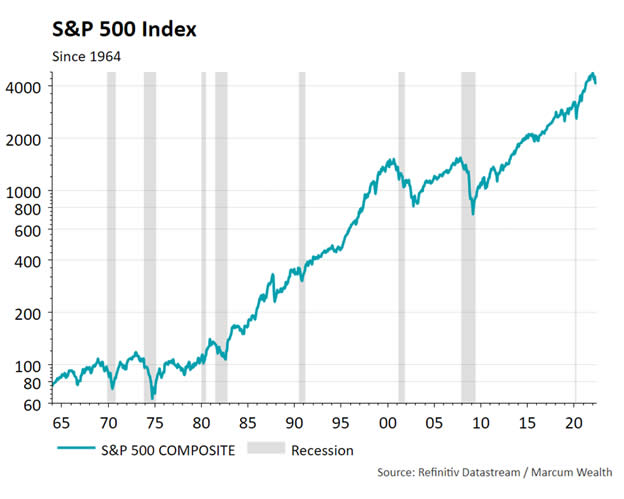

Once the economy is in a recession, it is typically old news to the stock market. In fact, markets typically bottom several months or quarters prior to a recession being officially called by the National Bureau of Economic Research. The chart below shows recessions marked in grey vertical bars. In 7 of the 8 recessions, stock prices bottomed well before the next expansion began.

This goes to the old adage, “Buy at the sound of cannons and sell at the sound of trumpets.” To those with diversified portfolios, this means buying or selling around your asset allocation targets – it does not mean going all-in or all-out.

In Thinking Fast & Slow, Nobel Prize winner Daniel Kahneman describes our brains as having two systems. System 1 reacts quickly and is useful in many scenarios. This would be investors thinking recession = time to sell stocks. System 2, on the other hand, thinks slowly, analyzing and deducing information. This would be investors thinking recession = time to buy stocks.

Of course, every cycle is unique. The current cycle certainly is on fast forward as compared to the expansion from 2009 to 2020. Unemployment is below 4%, the Federal Reserve is raising interest rates, and the stock market packed in a decade of gains in just two years. The data may be at the early stages of trending negative, but the calls for a sustained decline in economic activity may be premature.

We will invariably have a recession again. The question is whether financial plans and a durable investment process is in place to navigate to the next cycle.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.