The bills eventually come due. The U.S. has a self-imposed limit on how much debt it may issue. Congress approved the spending contributing to the debt increase during its annual budget last fall. When the leaves change is when the negotiation period for future spending occurs. For some reason, the number approved for spending does not correspond to an increase in the debt level.

The crux of the matter is not the US’s ability to pay but rather its willingness. As the issuer of the world’s reserve currency, the US enjoys the “exorbitant privilege” of issuing debt in its currency at favorable interest rates.

Before 2011, raising the debt ceiling was a mere formality. I recall writing about this during the first episode of the debt ceiling debates in the summer of 2011. The event spurred worries about a significant increase in interest rates. The opposite happened. Interest rates plunged in a flight to safety trade. Stocks sold off by 20% but bounced back in the year’s final months.

Since then, markets began to view the debt ceiling debate in Washington as the boy who cried wolf. The US hit the debt ceiling in 2015, 2017, 2019, and 2021. While much noise came out of Washington, it always raised the limit. No one wanted to have blood on their hands from seeing the stock market drop or not paying military veterans their pensions.

However, the 2023 debt ceiling seems different from previous iterations. The animosity in Washington and the difficulty in electing a speaker of the House back in January show more dysfunction than usual. It has markets concerned. The price to insure against a U.S. default in one corner of the bond market is now the highest it has been in the last 15 years.

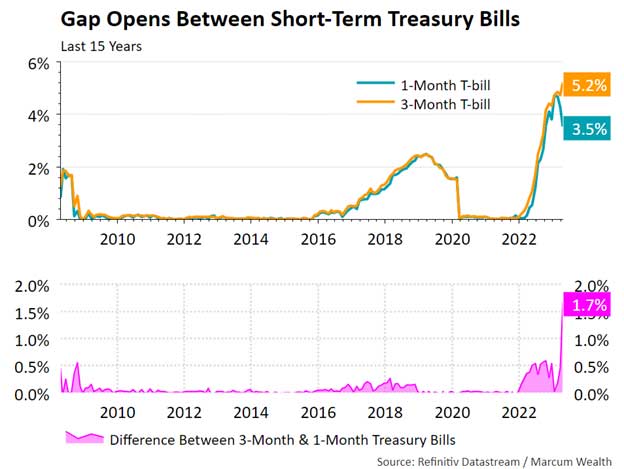

Another concerning development is the widening gap between one-month and three-month Treasury bill rates, with the former trading at significantly lower rates. Investors are wary of holding short-term debt when it matures, as there could be a delay in receiving the principal repayment.

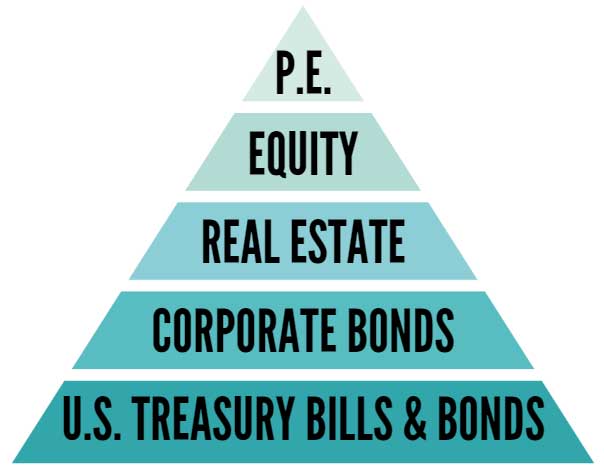

Why is this such a big deal for markets? U.S. Treasury bills form the base of investable assets. It is the risk-free asset of which all other assets price risk and return. The pyramid below conveys this going from private equity at the top as the riskiest to Treasury bills as having the least risk. Treasury bills refer to shorter duration, usually from a few days to a year in maturity. Treasury bonds refer to longer duration maturities, between 10 and 30 years.

Estimates of hitting the debt ceiling moved forward to June or July this summer. Tax receipt collections are running lower than estimated after the recent tax due date in April. Treasury could use extraordinary measures to keep the lights on a bit longer.

It is difficult to make predictions, especially in Washington. We recognize the variability of outcomes in these unknown periods. Eventually, the debt ceiling will rise.

We will continue to monitor the events and data as the debt ceiling approaches. Our approach is to respond to events with the scenario analysis we have already conducted, to thoughtfully position portfolios to protect capital, and take advantage of opportunities.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.