Time to Revisit Asset Allocation

By Michael McKeown, CFA, CPA - Chief Investment Officer

Risk taking by traders is more aggressive now than it has been in a long time. Options buying and volume traded by retail investors is at the highest level in years. Celebrities and high profile media people are tweeting about stocks more than ever.

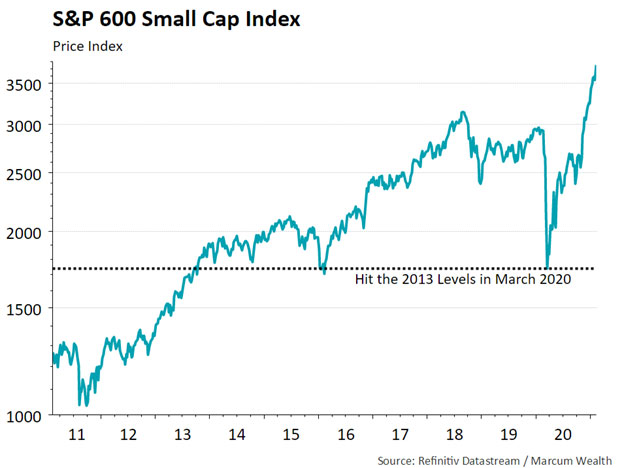

A year ago, in March 2020, small cap stocks had a brutal selloff. Prices fell over 40% in just a month. Since then, small cap stocks have more than doubled off their lows. Nearly 50% of this gain has come in just the last 4 months. Positive vaccine news, clarity on elections, and economic re-opening hopes propelled the index higher.

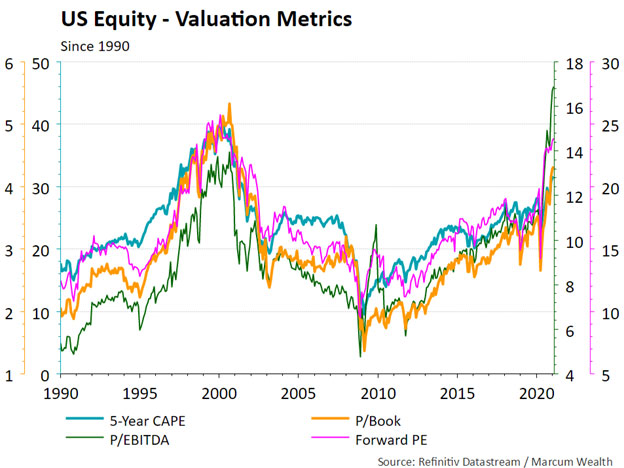

No matter how we slice the data, valuations across most markets look high compared to the past. The four data series below illustrate this. Whether its cyclically adjusted earnings, price to EBITDA, price to book, or forward price to earnings, all are in the top 10% of the past 30 years.

High valuations means little in the short-run. Momentum is the most important factor for prices. Or more simply, an object in motion tends to stay in motion. Markets can often move faster and to a greater extent than statistics predict.

Most pensions, endowments, and families have an asset allocation target. That is the target mix between stocks, bonds, real estate, and other asset classes. Given the run-up in stock prices, most portfolios are above these targets.

We believe it is a prudent time to begin moving back towards the asset allocation targets. This will ensure the financial plan stays in line with the intended risk levels. It also allows for future rebalancing. This may mean moving back into stocks if prices were to pause or fall. Or this could be future trimming if markets trend up.

The sentiment has certainly shifted from negative in March 2020 to positive today. We wrote about this in the depths of the pandemic and what investors needed to be thinking about then.

Now, there is plenty of positive news as the economy looks robust in 2021. More stimulus, the vaccine roll out, and pent up demand from households gives a strong backdrop.

Regardless of the outlook, investors should have a North Star that guides their own target asset allocation. Basing this on a comprehensive financial plan combined with an investment process increases the likelihood of financial success.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.