Lessons from the Great Depression are with us today. In 1932, President Hoover hoped the free markets would restore itself and the 25% unemployment rate. The lack of policy intervention led to failure and a new Presidential administration.

Fast forward to 2020. Faced with spiraling unemployment due to the pandemic, policy makers chose a different path. This led to swift action a year ago, with trillion-dollar spending packages and the Federal Reserve stepping up.

The goal was to avoid a deflationary spiral that can occur with too little economic stimulus. The risk is higher inflation and currency weakness.

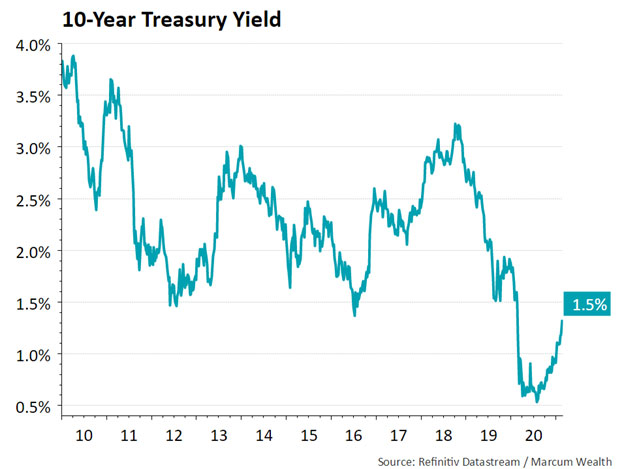

Interest rates jumped sharply this week after trending higher over the last six months. This is common following recessions. Investors see a higher growth trend for the economy, along with potential inflation.

While rising interest rates can be a good sign for the economy, bond investors have to digest a price adjustment on the downside. While painful, the silver lining is higher yields, which means higher expected returns going forward.

Let’s look at how high and fast yields rose in the past. We will stick to post-2008 since many market dynamics changed from the prior period. In addition, yields have been below 4% since then. The composition of the benchmark Barclays U.S. Aggregate Bond Index is different today than the past. This is mainly in its yield, spreads, and duration. It still gives a baseline for discussion.

The majority of the interest rate move was over after a 1% (100 basis points, or bps) rise in the past. The ‘taper tantrum’ in 2013 was the fastest with the deepest price decline. The rise that began in 2017 was the longest in time. Forward returns were positive one year later in each of the previous instances after a 1% rise.

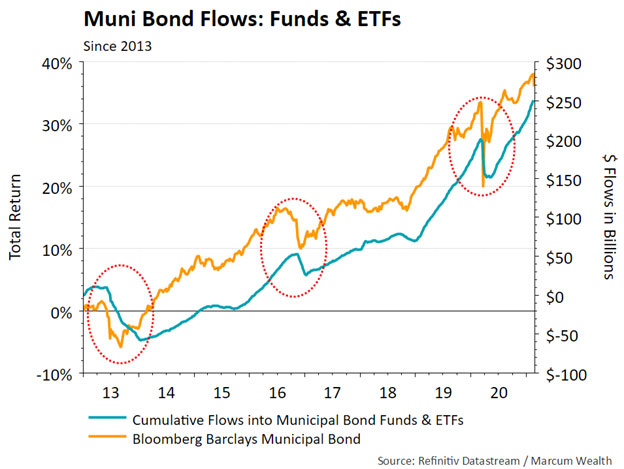

Investors put $100 billion into municipal bond funds since March 2020. The search for yield is real with cash yielding nothing. With municipal bonds returns now negative in the first two months of 2021, the potential for selling increases. During past periods of weakness (2013, 2018, 2020), investors pulled $25 to $50 billion out of the municipal market.

Municipals could be an area for investors to consider once the dust settles.

Equities sold off with bond yields rising this week. In particular, high growth companies fell sharply after a strong run. The cost of capital matters eventually for companies, even if business fundamentals are doing well. It would not seem the 10-year Treasury yield should matter as to these stocks with such amazing stories. Yet, when yields have risen in the past relative to expected earnings growth, it has given equity markets a reason to pause.

We continue to monitor markets for opportunities across equities and fixed income.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.