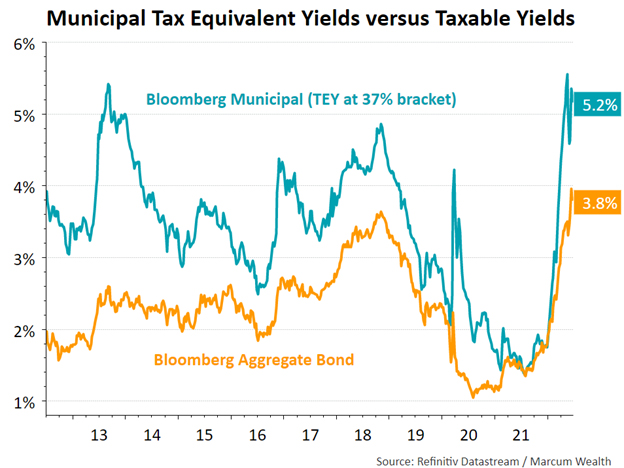

Chart of the Week

This is the only business where prices go on sale and people rush out the door. With yields up and bond prices down, investors have been selling bonds at the fastest pace in two years. This is despite municipal bonds offering a yield on a tax-adjusted basis above 5%. Last year, this was below 2%. The spread is above the 10-year average.

What We’re Reading

The Survival Instinct of Money – More To That

Eye on the Markets: Independence Days – JPMorgan

6 Things to Know About Stock Market Crashes and Downturns – Morningstar

So You Think We Might Be in a Recession? – Econbrowser

For Lessons on Fighting Inflation, Skip Over Volcker to 1946 – Guggenheim

Podcast of the Week

Five Reasons Everybody Is Wrong About a U.S. Recession – Including Me – Plain English, The Ringer

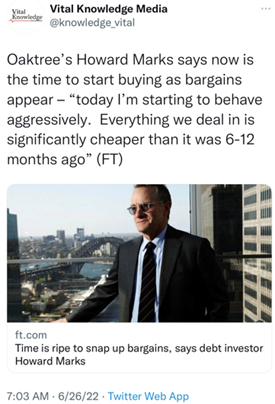

Tweet of the Week

Oaktree manages $164 billion on behalf of its clients. CEO Howard Marks is known for being a prudent value investor and for the memos that he began sending out by hand 30 years ago. This week he spoke with the Financial Times and said that while it is tempting to try and hold out for the bottom in stock and bond prices, now is the time to buy. He added that assets could become cheaper than current valuations, “in which case we’ll buy more.”

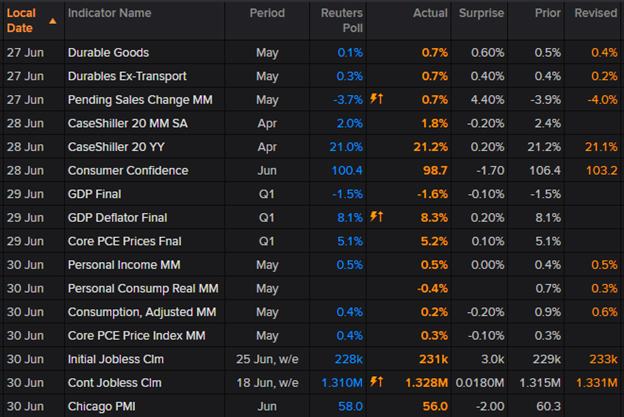

The Past Week

Durable goods orders surprised on the upside to start the week of June 27th. On Tuesday, consumer confidence came in below expectations while the final first quarter GDP report was revised down by 0.1% to -1.6%. On the positive side, inflation pressures continued to drop as core prices rose 0.3% on a monthly basis. Personal income data also came in above expectations. On the downside, consumer spending grew by 0.2% but less than expected, and was negative on an inflation-adjusted basis.

The Week Ahead

With the Fourth of July on Monday, we have a holiday-shortened week. There will be plenty of data to watch closely, including the PMI (Purchasing Manufacturers Index) and the monthly jobs report on Friday. Consensus expectations are for an additional 295,000 jobs and the unemployment rate to hold steady at 3.6%.

Talk to you next week.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.