Chart of the Week

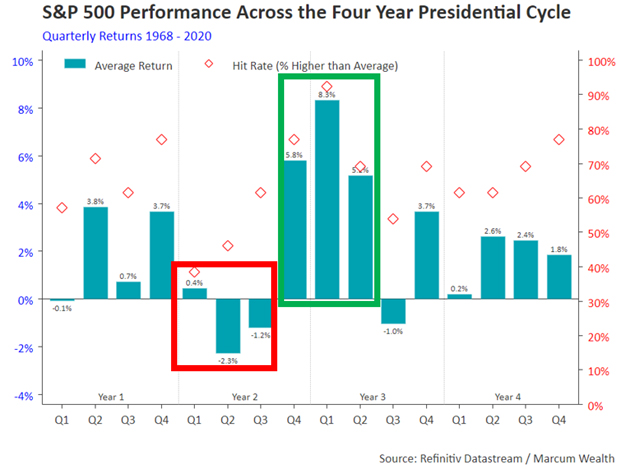

Dividing the four years of the Presidential cycle into 16 quarters reveals an interesting pattern. The first three quarters of the second year of the cycle are seasonally the weakest. The silver lining is that after mid-term elections, markets enter the period with the highest historical returns. This pattern has held regardless of the party in control of the Presidency or Congress.

What We’re Reading

Wealth vs. Getting Wealthier – Morgan Housel

24 Charts Show We are Living Better Than Our Parents – Full Stack Economics

Home Sellers Are Slashing Prices in Sudden Halt to Pandemic Boom – Bloomberg

How the Brain ‘Constructs’ the Outside World – Scientific American

Podcast of the Week

Fixed Income in Retirement Plans – Macro Markets

Tweet of the Week

With higher mortgage rates, the housing market is coming back down to earth. Less bidding wars and more inventory may be on the horizon.

The Past Week

The Week Ahead

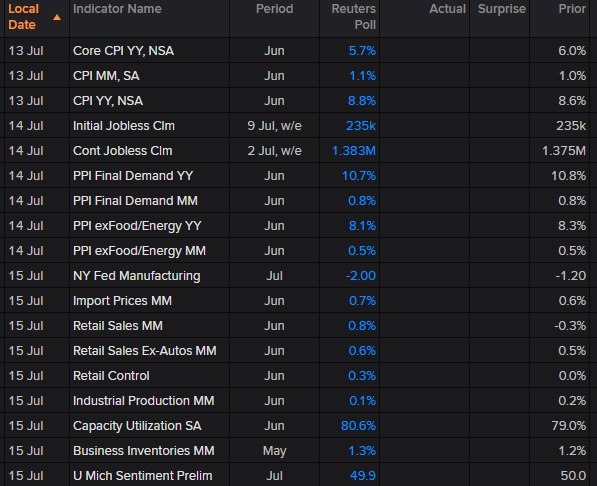

This week a number of Fed governors will be speaking and the tone of the speeches will be watched closely by the bond markets. The Wednesday CPI report will be key to see if inflation stays hot or looks like a slowing in the rate of change. On Thursday, JPMorgan kicks off earnings season, with a number of banks reporting the rest of the week.

Thanks for reading!

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.