Chart of the Week

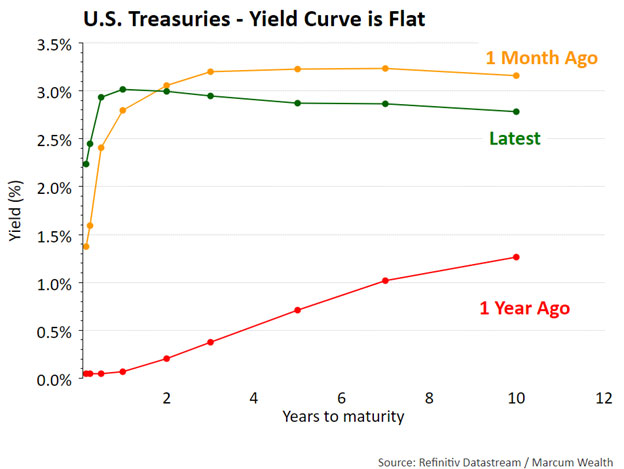

The Federal Reserve Open Market Committee (FOMC) is set to meet this week. The FOMC is widely expected to raise interest rates by 0.75%, moving the Fed Funds target rate to a range of 2.25% to 2.50%. Long-term interest rates fell over the past month while short-term rates continued rising. Markets anticipate more interest rate hikes throughout the rest of 2022. When short-term rates are above long-term rates, the yield curve is inverted. The forward prices indicate the three-month Treasury bill will be higher than the 10-year yield in the months ahead. This could give the FOMC cause for concern, as inversion typically indicates weaker growth ahead. Of course, this depends on how inflation data evolves.

What We’re Reading

Shifting Gears: Private Equity Report Midyear 2022 – Bain & Co.

Little Ways the World Works – Morgan Housel

How the Labor Market is Impacting 401k Plans – Plan Sponsor

Gazprom Declares Force Majeure: How We Got Here – Zeihan on Geopolitics

Podcast of the Week

Ivy Zelman on the Outlook for U.S. Housing – Macro Hive

The Past Week

The outlook for housing continues to decline, with the National Association of Home Builders survey falling to its lowest level in two years. Leading economic data continued a negative trend with more jobless claims. The Philadelphia Fed New Orders and Purchasing Manufacturing Index data declined as well.

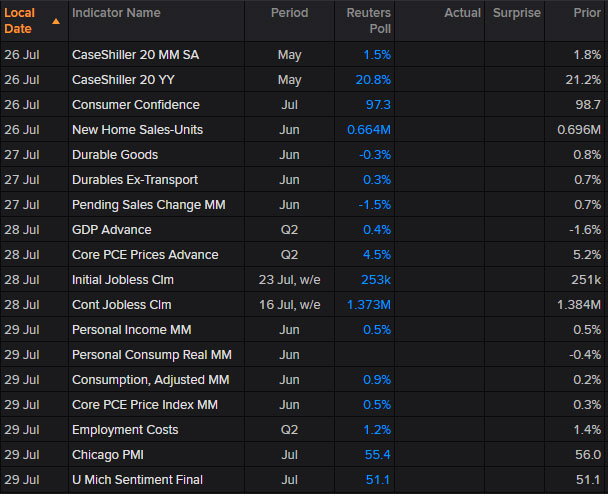

The Week Ahead

Second quarter GDP will be reported this week and may be negative. This would mark two consecutive quarters of negative growth, which meets the traditional technical definition of recession. The media will debate whether the economy is in fact in a recession. On the one hand, moving the goalposts from two negative GDP quarters does not seem right. On the other hand, it is hard to declare a recession with jobs growing at 372,000 in June and a monthly average of 457,000 jobs created over the last 6 months.

Regardless, the discussion is a distraction from what matters to markets, which is earnings. We enter the heaviest week of the quarter with 169 S&P companies reporting, representing nearly half of the market value. This list includes Apple, Microsoft, Amazon, Google, and Facebook. For companies that reported this quarter, earnings grew 6% on average over the past year with 67% of companies above expectations. Earnings estimates are beginning to come down for the next year.

Talk to you next week.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.