Chart of the Week

Investors came into the end of October positioned defensively and feeling negative based on sentiment surveys. Strong growth, lower inflation, and the Federal Reserve seemingly done with interest rate hikes led to a stock market rally.

It was the best weekly performance for the S&P 500 since last November. The 5.8% increase places it in the top 2% of weekly changes since 2010. Many strategists point to the positive momentum and seasonally strong period into yearend leading to more gains. Others see geopolitical concerns and valuation keeping investors on the sidelines.

What We’re Reading

Lawsuit Against Real Estate Brokerages, Realtors Will Reshape Home Buying – Business Insider

Outlook for Private Markets – Apollo

What Is the Right 401(k) Contribution Rate? – Morningstar

The Passing of Byron Wien has us remembering his life lessons for the next 80 years – Blackstone

Podcast of the Week

Interview with the Legendary Charlie Munger – Acquired

Last Week

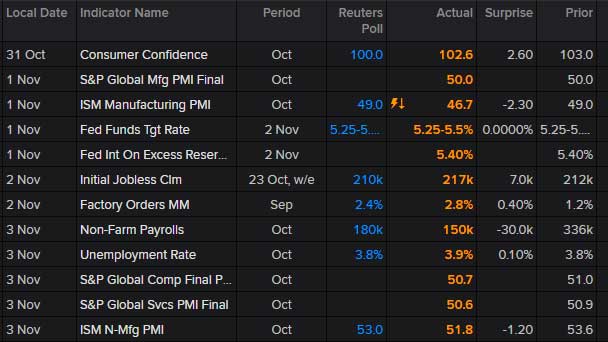

The Fed held interest rates steady at the second straight meeting. This leads investors to believe the last hike of the cycle was in July. The monthly jobs report fell short of expectations and the unemployment rate increased to 3.9%. Services data for October showed expansion but at a slower pace.

The Week Ahead

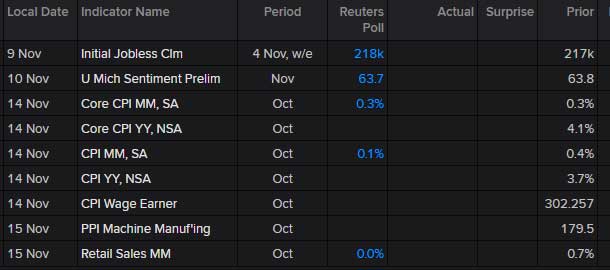

Consumer sentiment, inflation data, and retail sales are the key reports over the next week that investors will watch.

Thank you for reading.

Important Disclosure Information

Marcum Wealth, LLC (“Marcum”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply a specific level of skill or training. A copy of Marcum’s current written Disclosure Brochure discussing its advisory services, fees, and material conflicts of interest is available upon request.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum), or any non-investment related content, made reference to directly or indirectly in this communication, will be profitable, equal any corresponding historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Certain strategies and vehicles referenced in this communication, such as private investments, Opportunity Zones, and ESG investing, may present increased or novel risks, including potentially higher management fees, reduced liquidity, shorter performance histories, or increased legal or regulatory exposure, compared to more traditional publicly traded securities and investment strategies. All investors should consider these potential risks in light of their individual circumstances, objectives, and risk tolerance. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. The asset allocations reflected in this communication are targets only. Actual allocations can and often will deviate from these targets, including in instances of volatile markets, large deposits or withdrawals, or during account rebalancing.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and (3) a description of each comparative benchmark/index is available upon request.

Not all services described herein will be necessary or appropriate for all clients. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. The potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances, and overall objectives. Neither personalized services nor financial or professional resources or processes should be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.

If you are a Marcum client, please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify/advise us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. Tax and accounting services provided by Marcum, LLP. Insurance services provided by Marcum Insurance Services, LLC.