Let’s Not Spike the Football

By Michael McKeown, CFA, CPA - Chief Investment Officer

Back in the 1960s, the touchdown celebration was much different than today.

After scoring, players would launch the football into the stands, but this came with a heavy fine from the league. Homer Jones, a receiver for the New York Giants, inadvertently changed the game when he celebrated an 89-yard touchdown catch by throwing the ball into the ground.

Today, the league is a lot more fun with jumps into the stands, group celebrations, or one of my favorites – when a running back gives the ball to a big offensive lineman to thunderously slam the ball into the ground.

Or another professional move – the quiet option – a nonchalant flip of the ball back to the referee.

Should we celebrate the big drop in inflation?

It may not be time to spike the ball just yet, but a little recap first.

We discussed this trend before – how wages were coming down from highs, supply chains were healing, and the lag in housing inflation would catch up.

And that it would lead to the Fed ending its interest rate increases (see our July video – The Last Fed Interest Rate Hike?). It seems the bond market and Fed officials are finally on the same page as interest rates fell and bond prices rallied.

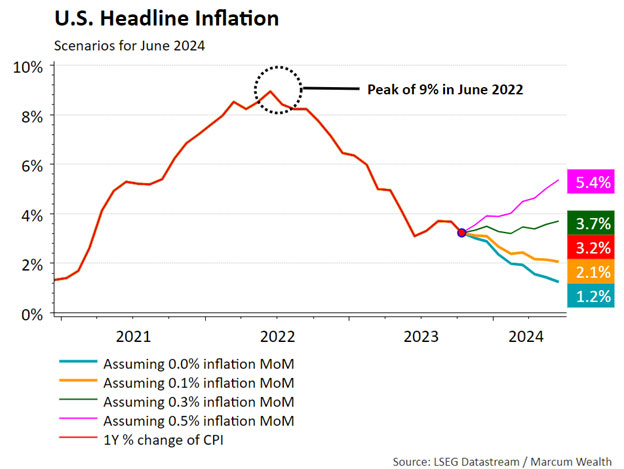

The October Consumer Price Index report showed a 0% change in monthly inflation. If we continue to similar low prints in the months ahead, inflation will continue towards the Fed’s target.

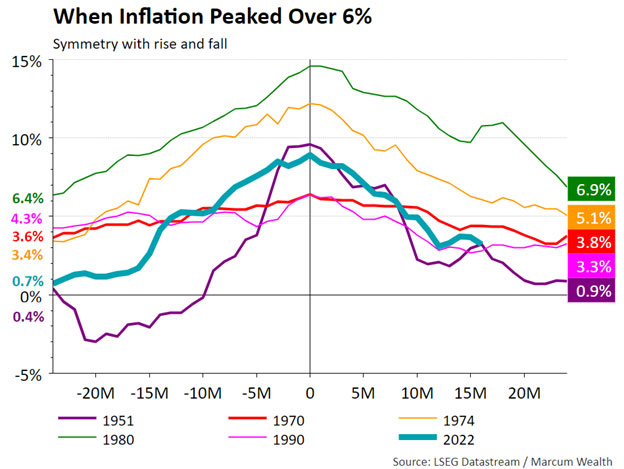

The spike and decline in inflation followed the pattern of past high inflation periods. This one most closely resembles 1951, which was wartime spending for Korea that quickly saw inflation fall back.

So, the economy is in perfect shape? As famous football commentator Lee Corso would say, “Not so fast my friend.”

Wide deficits continue to fuel spending. With household balance sheets in such great shape, the risks that a second wave of inflation will return later in this cycle are not zero.

We also have to monitor the labor market. The momentum over the last few years may be turning. In October, we added just 150,000 jobs (the lowest amount in nearly three years), and prior months were revised down.

Temporary hires are down. Average hours worked are down. Job openings are down. These are not kill shots by any means, but just data points we need to watch as the data evolves over the coming months.

If there’s one lesson in investing, it’s to never get too high or too low. Long-term trends take a while to play out. Once you think you have it figured out, a change out of the blue can humble any process.

Important Disclosure Information

Marcum Wealth, LLC (“Marcum”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply a specific level of skill or training. A copy of Marcum’s current written Disclosure Brochure discussing its advisory services, fees, and material conflicts of interest is available upon request.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum), or any non-investment related content, made reference to directly or indirectly in this communication, will be profitable, equal any corresponding historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Certain strategies and vehicles referenced in this communication, such as private investments, Opportunity Zones, and ESG investing, may present increased or novel risks, including potentially higher management fees, reduced liquidity, shorter performance histories, or increased legal or regulatory exposure, compared to more traditional publicly traded securities and investment strategies. All investors should consider these potential risks in light of their individual circumstances, objectives, and risk tolerance. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. The asset allocations reflected in this communication are targets only. Actual allocations can and often will deviate from these targets, including in instances of volatile markets, large deposits or withdrawals, or during account rebalancing.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and (3) a description of each comparative benchmark/index is available upon request.

Not all services described herein will be necessary or appropriate for all clients. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. The potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances, and overall objectives. Neither personalized services nor financial or professional resources or processes should be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.

If you are a Marcum client, please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify/advise us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. Tax and accounting services provided by Marcum, LLP. Insurance services provided by Marcum Insurance Services, LLC.